The new Major Market Movements fully featured website, including blog, forum and chart school is up and running!

You can find it here: www.MajorMarketMovements.com

I want to thank all my subscribers and supporters over the years. It has been your interest in charting and technical analysis of markets that have spurred me on to create a place for traders to come together to focus on the technical methods that are so often responsible for 'Major Market Moves'.

This BlogSpot site will still be left open as an archive, but no new content will be generated on this site. All new blog posts will be posted at the new website under the 'Blog' tab. I will also be posting more frequently, not just on the weekends.

All the best to you and thanks again,

Quad G

Dedicated to the pursuit of identifying significant turns and trends in multiple markets using the Elliot Wave Theory, Japanese Candlesticks, Cycles, Seasonals and basic technical analysis.

Tuesday, September 10, 2013

Sunday, September 8, 2013

MMM is Moving

My Faithful Audience,

My new website is currently under construction, being tested, and very close to launch! Therefore the Weekend Update will be postponed, if all goes well the next blog update will be at the new site.

I will keep you posted here about the transition, which may come inside the next few days.

All the best,

Quad G

...

My new website is currently under construction, being tested, and very close to launch! Therefore the Weekend Update will be postponed, if all goes well the next blog update will be at the new site.

I will keep you posted here about the transition, which may come inside the next few days.

All the best,

Quad G

...

Sunday, September 1, 2013

MMM Weekend Update 9-1-13

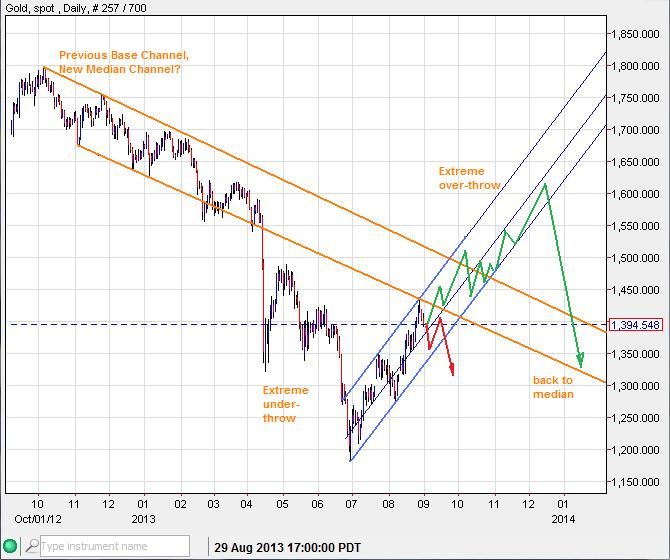

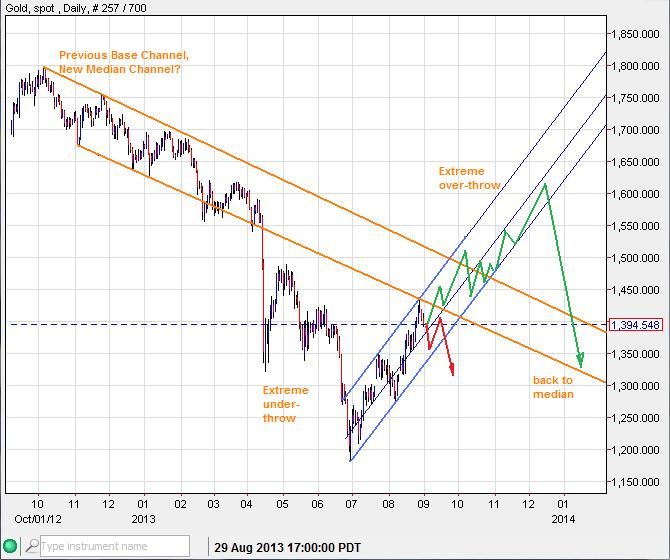

Gold - The impulsive moves higher over the past few weeks have certainly confirmed that the aforementioned 21-22month cycle is certainly logging in a significant bottom similar to significant tops in the past. The next iteration comes in the spring of 2015 (March/April). The MT trend moving into that cycle will determine if it will be a cycle top or bottom. I suspect that if the price stays under the primary down trend-line above (black) in the coming weeks, the next cycle will likely be a low.

The price has fallen back this past week after bumping into the previous base channel. This base channel could become a median channel. We've already seen the acceleration channel down into an extreme under-throw. The current move up could be an extreme over-throw taking place before the trend settles back down into the median at a later time. A premature break-down below (red) of the current up channel (blue) would disrupt this scenario.

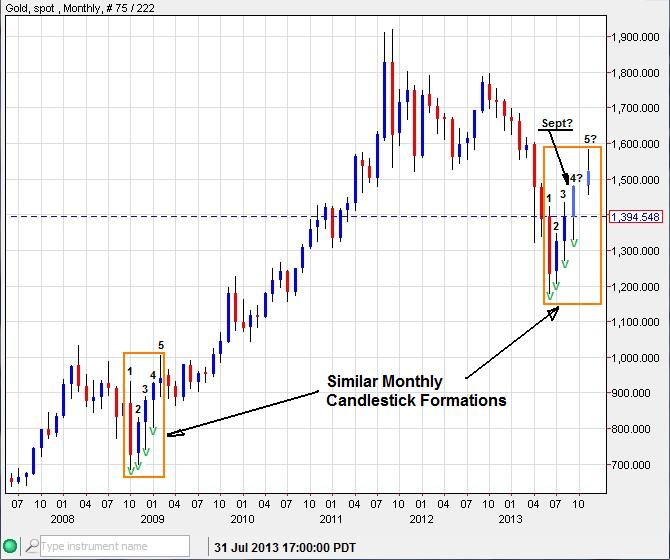

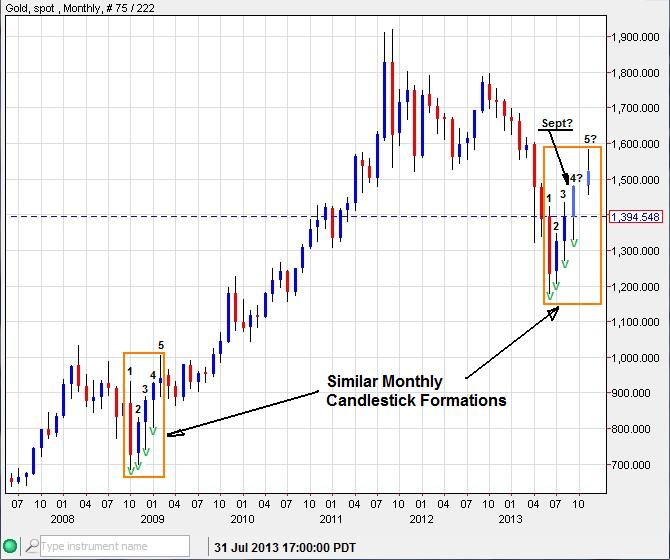

The Monthly close last Friday is uncannily familiar to the monthly candlestick pattern that developed back during the 2008 bottom. If the same type of pattern were to repeat, this September should see a higher-low (green V) and then close the month higher than August.

The last weeks candle closed bearish, printing an inverted hammer candle. This suggests that follow-through to the downside is expected this week. Can hammer candles be breached? Sure they can, and when they do they can often produce an impulsive shot in the corresponding direction.

The New Moon cycle is also coming into play this week, opening up a turn window between the close on Sept 4th to the close on Sept 9th. If the ST trend remains down into this turn date window the chances are likely that a bottom will form. The opposite is also true, if the ST trend is up into that turn window it could form a top. So particular attention needs to be payed to the attitude of the trend moving into this New Moon cycle. The last two New Moon cycles nailed a bottom, could we have a three-peat?

A daily inverted hammer candle on August 28th alert my subscribers and I to the potential of a profit taking sell-off in the making. This was a good ST spec signal to take profit, lightening up on previous buys.

--------------------------------------------------------------------------------------------------------------------

GDX - Miners are very close to finishing some unfinished business this week, back-testing the previous break-out of a neckline (orange) and back filling a gap left behind. If Bulls want more of this market this would be the place to see them buy it up. The 40ish line of the Daily RSI(14) is often support when the market is MT bullish. A resulting move higher would aim for initial targets of 35 and 40, possibly much higher after that. If any of these supports are broken, then it would be a sign that bulls are AWOL.

-------------------------------------------------------------------------------------------------------------------

SPX - The S&P 500 is still in an impulsive trend to the downside. The 200DMA and an upward sloping trend-line (orange) become potential targets. I would also expect to see 30 or lower visited on the RSI (14). These targets look likely to be hit this month with a subsequent rise thereafter. A gap down was left behind, this could be filled later in September or October.

------------------------------------------------------------------------------------------------------------------

GBP/USD - Produced a textbook ending diagonal just below key resistance, producing a sizable and profitable reversal. Subscribers got the warning ahead of time.

-----------------------------------------------------------------------------------------------------------------

If you are a trader interested in learning and using useful technical tools, sign up for the MMM subscription service where I provide daily email updates on various markets.

Sigh up here:

http://majormarketmovements.blogspot.com/p/mmm-market-signal.html

Good Hunting,

Quad G

The price has fallen back this past week after bumping into the previous base channel. This base channel could become a median channel. We've already seen the acceleration channel down into an extreme under-throw. The current move up could be an extreme over-throw taking place before the trend settles back down into the median at a later time. A premature break-down below (red) of the current up channel (blue) would disrupt this scenario.

The Monthly close last Friday is uncannily familiar to the monthly candlestick pattern that developed back during the 2008 bottom. If the same type of pattern were to repeat, this September should see a higher-low (green V) and then close the month higher than August.

The last weeks candle closed bearish, printing an inverted hammer candle. This suggests that follow-through to the downside is expected this week. Can hammer candles be breached? Sure they can, and when they do they can often produce an impulsive shot in the corresponding direction.

The New Moon cycle is also coming into play this week, opening up a turn window between the close on Sept 4th to the close on Sept 9th. If the ST trend remains down into this turn date window the chances are likely that a bottom will form. The opposite is also true, if the ST trend is up into that turn window it could form a top. So particular attention needs to be payed to the attitude of the trend moving into this New Moon cycle. The last two New Moon cycles nailed a bottom, could we have a three-peat?

A daily inverted hammer candle on August 28th alert my subscribers and I to the potential of a profit taking sell-off in the making. This was a good ST spec signal to take profit, lightening up on previous buys.

--------------------------------------------------------------------------------------------------------------------

GDX - Miners are very close to finishing some unfinished business this week, back-testing the previous break-out of a neckline (orange) and back filling a gap left behind. If Bulls want more of this market this would be the place to see them buy it up. The 40ish line of the Daily RSI(14) is often support when the market is MT bullish. A resulting move higher would aim for initial targets of 35 and 40, possibly much higher after that. If any of these supports are broken, then it would be a sign that bulls are AWOL.

-------------------------------------------------------------------------------------------------------------------

SPX - The S&P 500 is still in an impulsive trend to the downside. The 200DMA and an upward sloping trend-line (orange) become potential targets. I would also expect to see 30 or lower visited on the RSI (14). These targets look likely to be hit this month with a subsequent rise thereafter. A gap down was left behind, this could be filled later in September or October.

------------------------------------------------------------------------------------------------------------------

GBP/USD - Produced a textbook ending diagonal just below key resistance, producing a sizable and profitable reversal. Subscribers got the warning ahead of time.

-----------------------------------------------------------------------------------------------------------------

If you are a trader interested in learning and using useful technical tools, sign up for the MMM subscription service where I provide daily email updates on various markets.

Sigh up here:

http://majormarketmovements.blogspot.com/p/mmm-market-signal.html

Good Hunting,

Quad G

Labels:

Break-Out/Back-Test,

Candle Sticks,

Ending Diagonal,

GBP/USD,

GDX,

Gold,

iHnS,

moon cycle,

SPX

Subscribe to:

Posts (Atom)