Weekly:

Strong weekly time fibo hit last week for a possible bottom:

I have been sending out free QG3 signals for Gold and Silver last week to those that have emailed me with interest. Also in the comment section of my blog posts and at my thread Major Market Movements at Kitcomm.com. My video is in the final editing stages, though taking much longer to complete than anticipated.

-------------------------------------------------------------------------------------

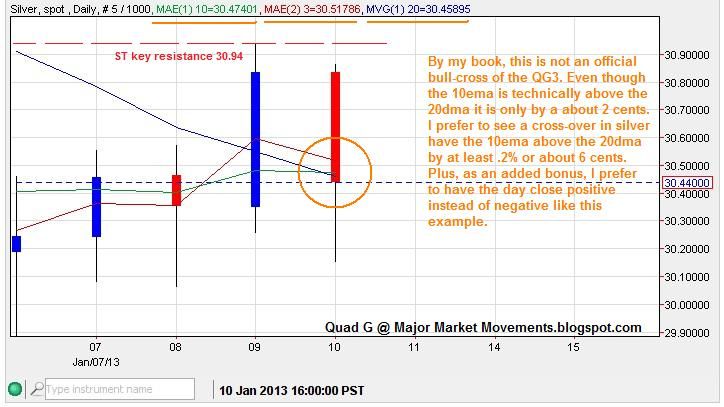

Silver - Ended the week much better than Gold:

Weekly:

-------------------------------------------------------------------------------------

Platinum - Could produce a strong break-out soon to the upside that could challenge 2100+, but MUST stay above 1511.25 in the MT:

Zoomed in:

-------------------------------------------------------------------------------------

Crude - The completion of wave (D) or something greater could be realized soon.

Previous chart from early December:

update:

-------------------------------------------------------------------------------------

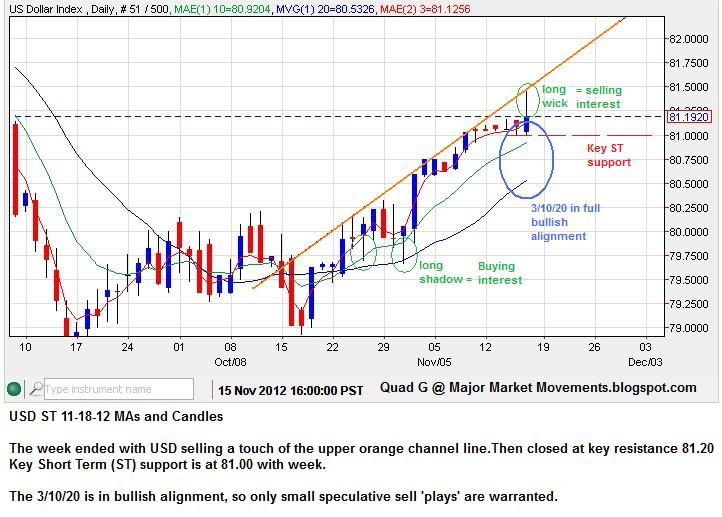

USD - Currently boxed in between key support and resistance, a break of 79ish could invite a fall to 74ish:

------------------------------------------------------------------------------------

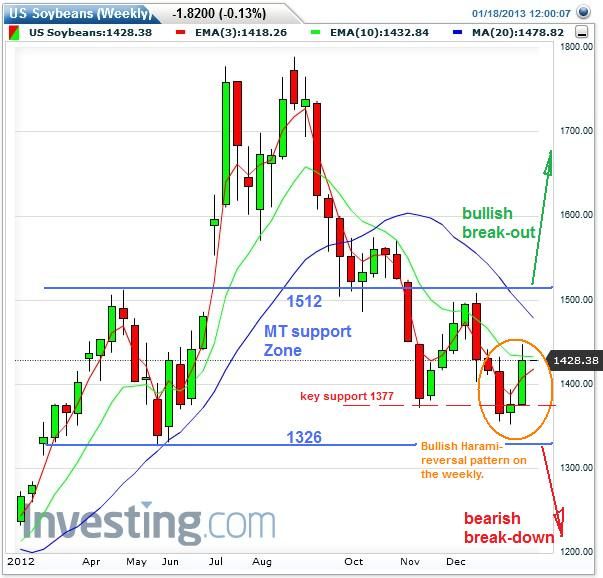

Soybeans - Produced a Bullish Harami candlestick pattern on the weekly. Follow through should keep above 1377 and challenge 1500 in the ST.

-------------------------------------------------------------------------------------

Good Hunting this week!

QG