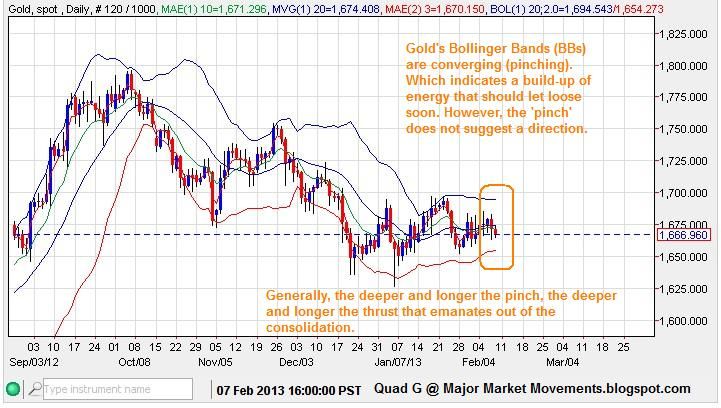

And with the Bollinger Bands clearly 'pinching', a thrust out of this consolidation period could come very soon:

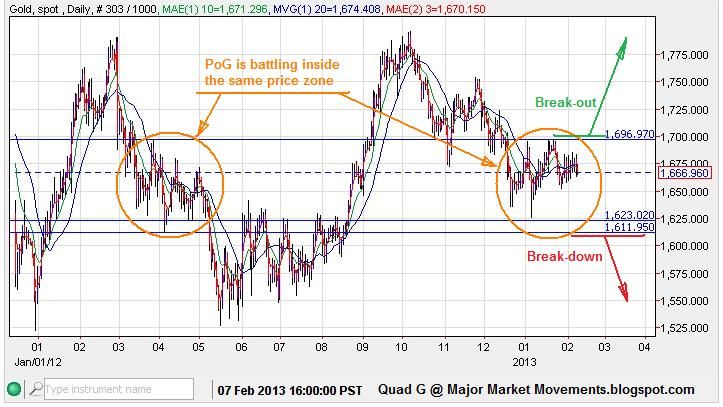

A fight in this price zone has taken place before. The bears won the last battle, will they win again?:

---------------------------------------------------------------------------------------------------------------------------------------

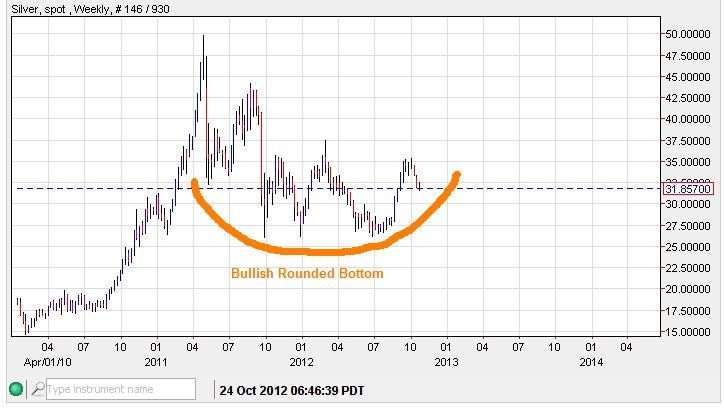

Silver - Same as gold, losing much of it's momentum, with the QG3 very close to producing a bearish cross-over:

Silver also feeling the 'Pinch':

--------------------------------------------------------------------------------------------------------------------------------------

Platinum - The QG3 is still in a bullish alignment, however weakness in Gold and Silver and USD making a bullish cross-over suggests caution would be prudent with appropriate stops or hedges. Though a Handle is complete with the bullish pattern below, beware of a possible back-test of that handle down below, currently at 1571:

--------------------------------------------------------------------------------------------------------------------------------------

EUR/USD - A bearish Inside Key Reversal was printed on the weekly chart. The close for last week was in the lower 10% of it's range, so further downside should be expected this week:

--------------------------------------------------------------------------------------------------------------------------------------

USD - A second right shoulder of a MT bearish SsHsS could emerge over the next few weeks:

The longer term picture still suggests more downside for USD, as long as it remains inside the current Bearish triangle:

-------------------------------------------------------------------------------------------------------------------------------------

For daily email updates on the Gold, Silver, Platinum, GDX, GLD, SLV, Euro and JPY markets using the QG3 subscribe here: QG3 Market Signal Service

The content in this blog post if for informational purposes only and is not a recommendation to buy or sell any financial products or securities.

All the best to you this week,

Quad G