The action last week, posted a bearish candle which keeps the 3/10/20 ribbon bearish for the time being.

-------------------------------------------------------------------------------------

Silver - In the same predicament as gold. The top channel line is a key determinant.

Trade School - For those who trade ST, here is a very important indicator to keep track of on a weekly basis, no matter which market, silver shown for example.

-------------------------------------------------------------------------------------

Platinum - is exhibiting some bullish tendency while above critical ST support.

-------------------------------------------------------------------------------------

EUR/USD - Last week gave a very bullish impulsive wave to the upside. It's very possible that wave {iii} is under way with a breach of a bullish CnH rim-line.

Zooming out we can see how the smaller CnH pattern is part of a larger bullish iHnS pattern.

-------------------------------------------------------------------------------------

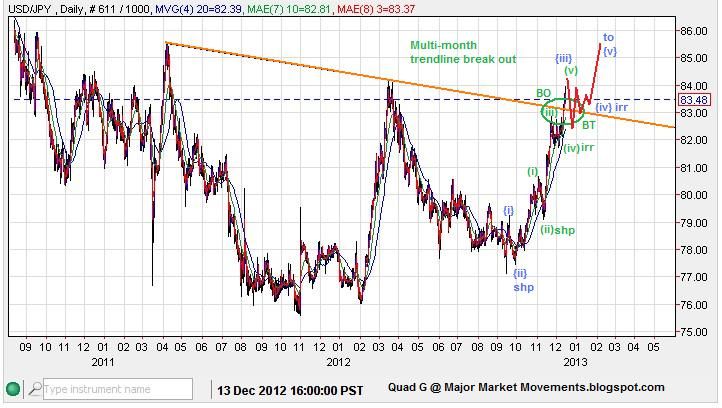

USD/JPY - So far has produced a picture perfect impulse wave to the upside, a few more undulations to go.

-------------------------------------------------------------------------------------

30 Year Bond Price - Moving up into a bearish rising wedge, likely a major generational top(60 years?) forming for this market.

If one were willing to bet the short side of the bond market, the ETF TBT could be an excellent vehicle. Though one more drop in TBT could be realized in the ST, once critical resistance (CR) is taken out, the bottom is likely locked-in.

-------------------------------------------------------------------------------------

Natural Gas - Hit $4.00 target, a large open gap below may act like a gravity well.

-------------------------------------------------------------------------------------

Soybeans - Have rallied from the bottom I called a few weeks ago to break key MT trendline. Key MT resistance is above at 1580ish.

Wheat - CoT Commercial and large traders are even while price hovers above support at $8.00

Corn - Key resistance at 745ish. A bullish double inside key reversal seen last Friday.

-------------------------------------------------------------------------------------

Have a great week!