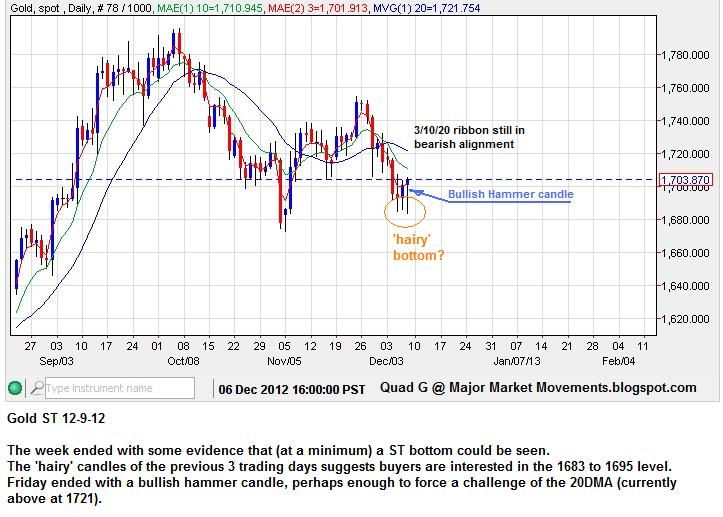

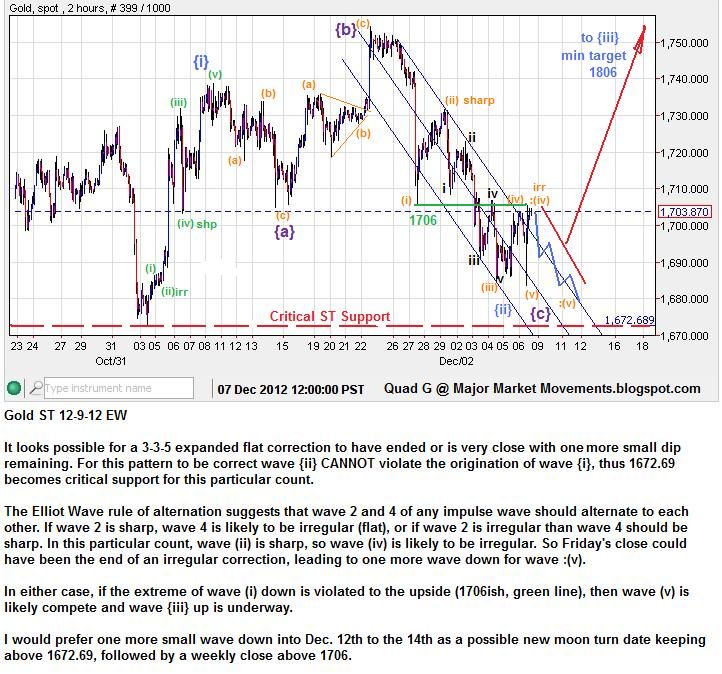

The 20 month moving average has been a major support on a closing basis since 2001.

LT gold bulls would still want to see the month close above this key MA. If December closes below 1661 and January also closes below the 20 month MA, it would be an unprecedented signal that a larger correction than 2008 is in the works.

-------------------------------------------------------------------------------------

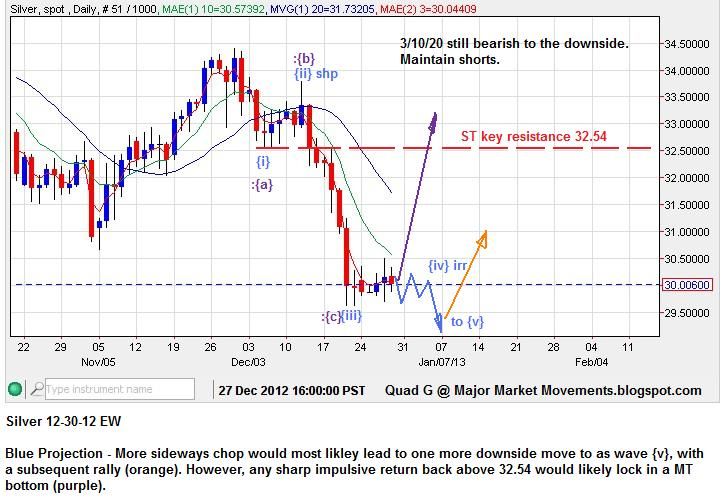

Silver - With more sideways chop this week, one more lower-low looks possible before a rebound.

-------------------------------------------------------------------------------------

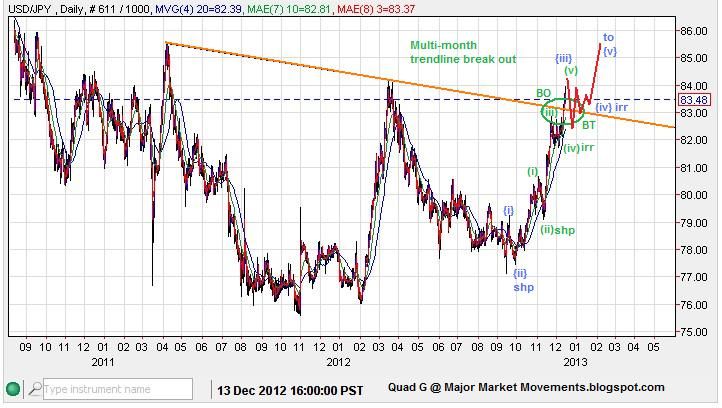

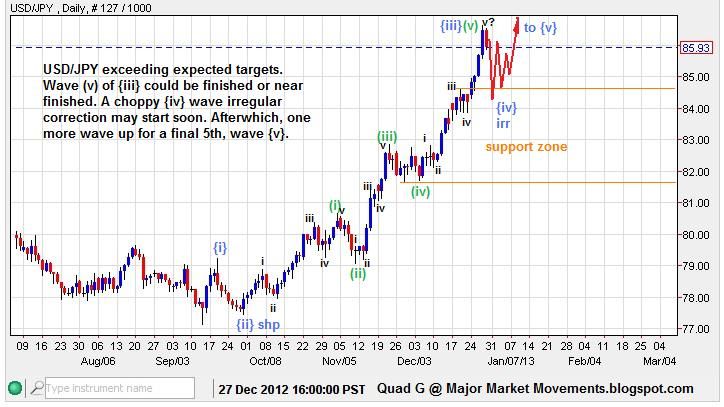

USD/JPY - My Long term term call for a major bottom in USD/JPY is confirmed with last week's close. I suspect that further impulsiveness in 2013 with drive USD/JPY to challenge 102 at a minimum.

zoomed in MT EW:

zoomed in ST EW:

-----------------------------------------------------------------------------------

The initial interest in a signal service was good, but still short of my goal.

The Service that I intend to provide would use the 3/10/20 ribbon as the back-bone of the system with varying rule-sets for initiating entry and exit signals depending on the market. This system targets swing trades, significant runs that last more than 2 weeks. I am simplifying the method to allow for easy entry and exit points and adjustment of stop loss levels within a few hours of daily market close (between 3:30 - 4PST for most markets). This way, at the end of the day a subscriber can take action, adjust stops and leave it alone for at least the following 24hrs. Every entry would have a stop-loss not exceeding 3%, most stop levels would be between 1-2%. A trader cannot control the price, but he can manage risk. This system would keep losses small, cutting losing positions short, while letting winning positions run. At first I would provide signals for Gold, Silver and EUR/USD. After some further refinement I would likely add other Forex and commodities.

I can send the signals by email and eventually by twitter. I want to package this service with an important video describing the 3/10/20 ribbon and the trading method. This will still take some time. I might have it all together before the end of January.

If you have any questions or comments feel free to leave a comment below or send an Email to quadg343@gmail.com

Good Hunting,

QG