The 3/10/20 ribbon is still in a bearish alignment and will remain that way with daily closes below the 20DMA (currently at 1701). The bulk of recommended shorts or hedges from 1715 back on December 3rd should still be kept, though some minor profit taking last Thursday and Friday would have been appropriate after a 4hr hammer candle bounce.

A Double Zig-Zag correction could be finished or near finished, if so a rally needs to take out key resistance at 1683.54 this week.

I mentioned at Kitco the completion of a 4hr bullish candle that effectively set at least a ST bottom.

-------------------------------------------------------------------------------------

Silver - The week ended down into the bottom 10% of it's range again, so chances favor at least an incremental low below last week's low of 29.61. The 3/10/20 ribbon is still bearish, so any physical purchases should be light, then become heavier once the ribbon turns back up and bullish.

The anticipated target of 29.66 (61.8% fibo retrace level) was reached.

-------------------------------------------------------------------------------------

GSR (Gold Silver Ratio)- gave a higher than expected bounce as a possible wave C of 2. The ratio needs to stay under the LT trendline resistance in order for Gold and Silver to maintain a MT bullish trajectory. When GSR moves up, PMs are bearish, when it moves down PMs are bullish.

-------------------------------------------------------------------------------------

USD - A secondary shoulder may develop this week and next, while the index remains above the neckline.

-------------------------------------------------------------------------------------

EUR/USD - I mentioned last week at Kitco that the Euro looked toppy and could fall to back test the previous break-out before advancing higher. Any move below the supporting trendline is a hazard to further upside in the MT.

-------------------------------------------------------------------------------------

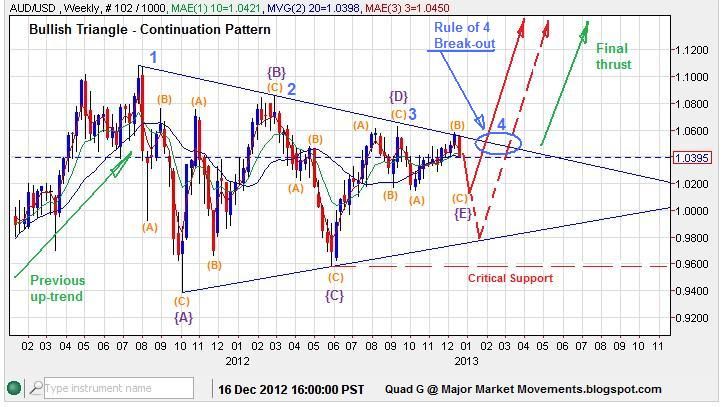

AUD/USD - A contracting triangle is near complete, one more dip to finish wave {E} may have started.

Gold and AUD/USD are fairly tight traveling buddies:

-------------------------------------------------------------------------------------

Corn - Price is currently working on wave C of 2. I suspect that if Corn bounces off support soon and recovers back above 735, a major bottom could be in place, followed by a rocket 3rd wave up that could challenge 1300.

-------------------------------------------------------------------------------------

I have a lot of spare time lately, my weekly job hours have taken a huge hit. I'm working on a video covering the details of the 3/10/20 ribbon and I'm considering a 'signal service', a monthly subscription($20) providing buy and sell signals across many markets with performance tracking. If any of you in this audience are interested, please leave a note here or contact my email at quadg343@gmail.com

Thanks much, all the best to you this week,

QG