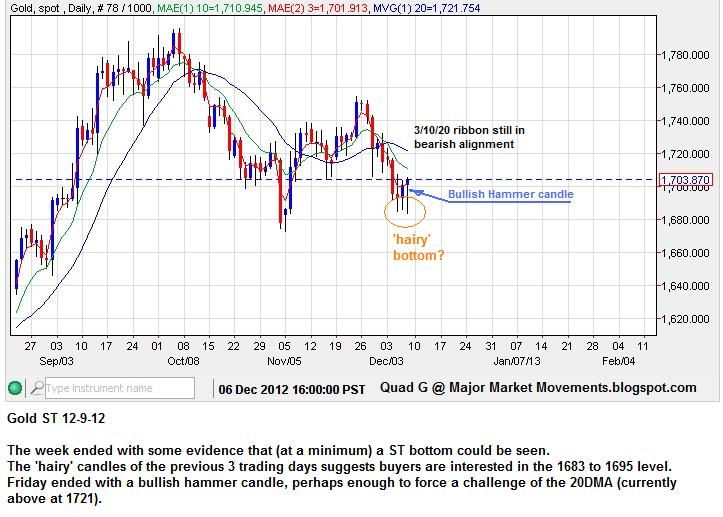

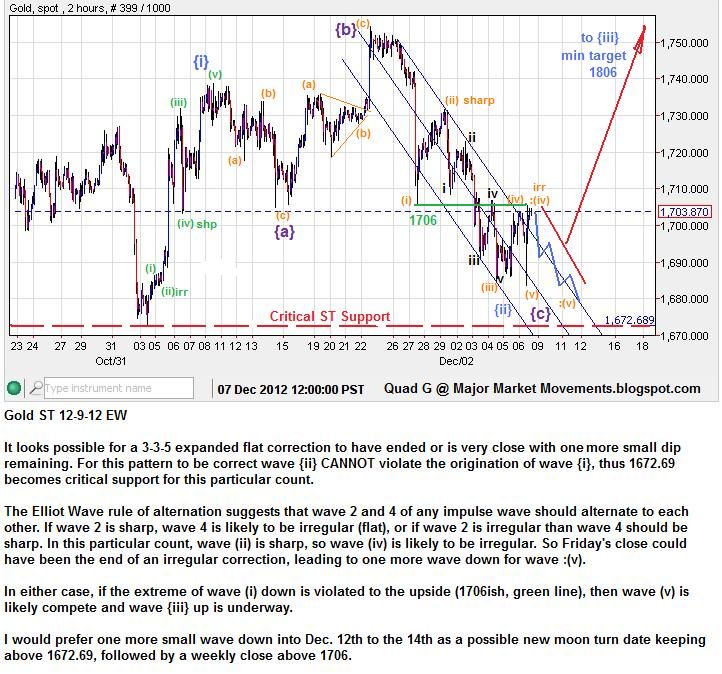

A ST EW count suggests a bottom is complete or near complete, which could usher in a 3rd wave surge up to 1806ish. All conditional on price remaining above critical support of 1672.69 this week.

-------------------------------------------------------------------------------------

Silver - Is in a tedious spot. The 3/10/20 ribbon is very close to turning bearish. Price must recover and close above the 10EMA to prevent a cross-over.

-------------------------------------------------------------------------------------

EUR/USD - The bearish collapse this week had some tell-tale signs. An Ending Diagonal (ED) is a weak 5th wave move that is often retraced fairly quickly:

I anticipate that this pull back is wave A of 2, a wave B bounce could develop this week.

A Cup and Handle could be forming, almost a polar opposite of what occurred in the first part of the year.

-------------------------------------------------------------------------------------

USD - The rally last week did have some advanced warning.

-------------------------------------------------------------------------------------

USD/CHF - A potentially very bearish long term EW formation would suggest that one more 5th wave down could be underway.

Since USD/CHF generally runs inversely to the price of Gold, an anticipated downward move in USD/CHF would support a rise on Gold price.

-------------------------------------------------------------------------------------

Crude (WTI) - Has some bullish potential, but price MUST stay above 77.30ish or risk a possible collapse to 45ish.

-------------------------------------------------------------------------------------

Thanks all for the support, much appreciated.