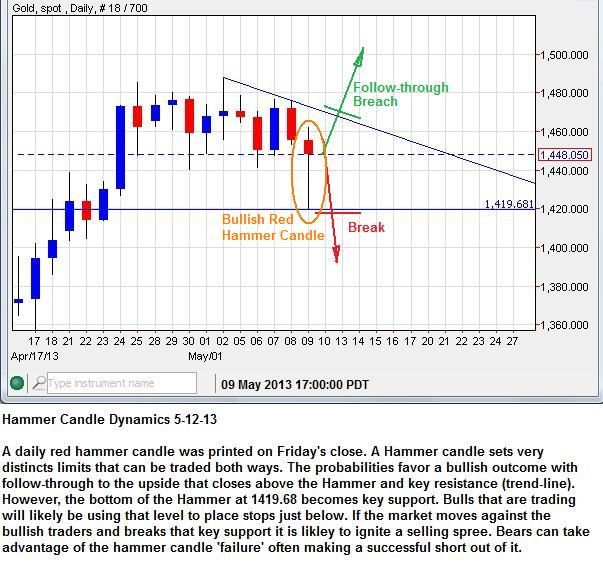

Last week closed with what is typically a bullish hammer candle on Friday, but it's important to understand the 'flip side' of such candles. Playing candles is playing probabilities, there is a bullish and bearish one in each hammer candle:

Here is an example of a bullish hammer candle that failed:

---------------------------------------------------------------------------------------------------------------

USD - Has been consolidating the last 4-5 weeks, a thrust to the upside could challenge a long term trend line above for the 4th time. As you know I'm a fan of the 'Rule of 4' (Ro4) which has a high probability of producing impulsive behavior when triggered.

---------------------------------------------------------------------------------------------------------------

AUD/USD - Has produced a great example of a Ro4 that was triggered to the downside:

---------------------------------------------------------------------------------------------------------------

Trade School - As part of my QG3 market signal service, I identify chart patterns that offer a high probability of providing a successful trading outcome. Recently I outlined a successful Ending Diagonal pattern in GBP/USD and a key bearish Hammer Candle as part of an ABC fibo price relationship in EUR/USD.

GBP/USD - Ending Diagonal

Outcome:

EUR/USD - Bearish Inverted Hammer on the Daily and ABC Fibo relationship:

Outcome:

------------------------------------------------------------------------------------------------------------

If you are interested in receiving my daily QG3 Market Signal Service updates, you can sign-up here:

http://majormarketmovements.blogspot.com/p/mmm-market-signal.html

The QG3 method of trading is not for everyone. I've included a 15 day trial period to check out the method to see if it works for you.

Good Hunting out there,

Quad G