Gold - Price gave a bullish MT signal with a Outside double Key Reversal on the weekly chart:

This is likely to cause additional MT bullishness in price as long as next week's close remains above 1682.26

Outside Key Reversals can be very strong signals, especially on a weekly time frame:

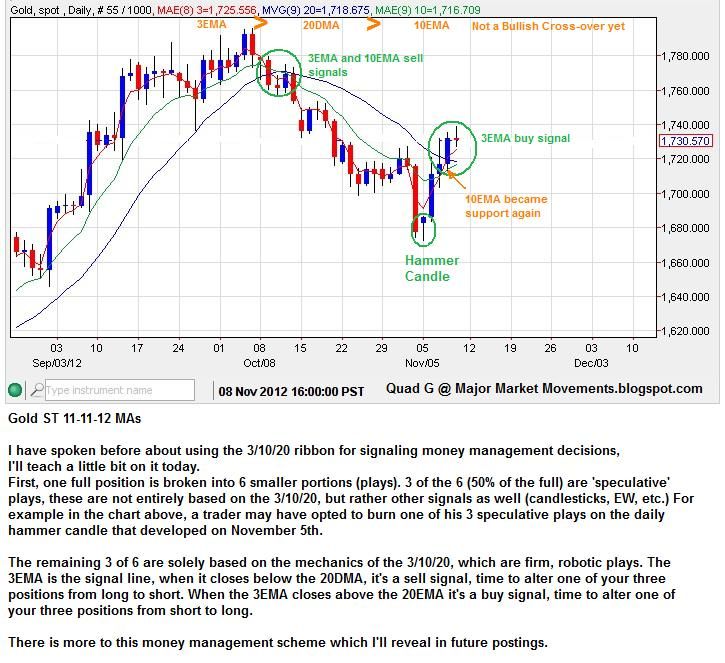

Though the week ended very bullish, the 3/10/20 ribbon has not made a bullish cross-over yet:

If PoG falls back this week, another opportunity for a speculative bid may present itself, using 1682 as an important back-stop to gauge risk.

-------------------------------------------------------------------------------------

Silver - Very similar to Gold with nearly identical moves:

-------------------------------------------------------------------------------------

USD/JPY - Weekly and daily indicators conflict with one another. On the weekly chart an Inside Key Reversal presents a bearish picture while price is below last week's open at 80.51

An IKR is not as strong as an OKR, but is still formidable.

The daily chart suggests price could be back testing some key support areas. The dragon-fly doji on Friday suggests a ST bottom may be forming:

The long term picture is still in the process of forming a major bottom while price remains below key MT resistance currently above at 83.22:

-------------------------------------------------------------------------------------

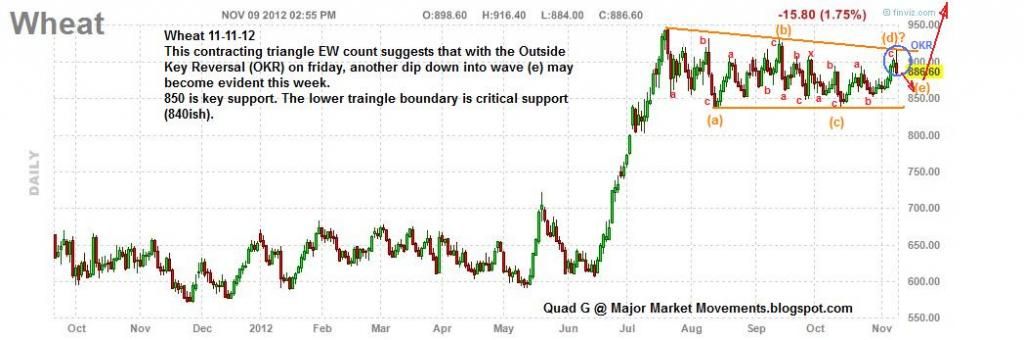

Wheat - Nearing the final stages of this multi-month correction. One more wave down may be seen this week completing the final wave (e) of a contracting triangle:

-------------------------------------------------------------------------------------

USD - At a crucial point sandwiched between key resistance at 81.20 and key support at 80.60

-------------------------------------------------------------------------------------

Ya'll have good week,

QG