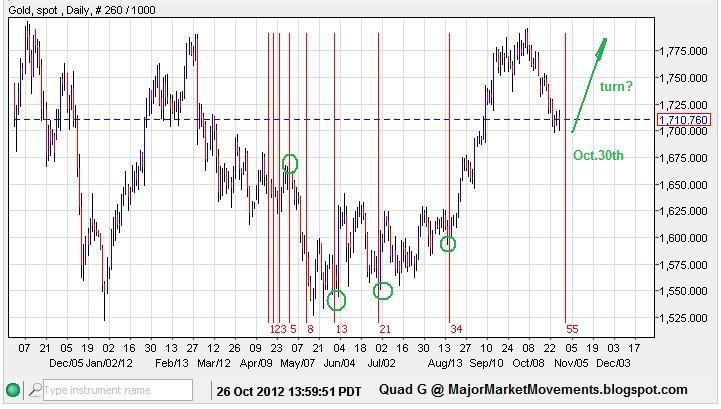

The 3/10/20 ribbon is 'Wide-Open' to the upside. As you can see the 10EMA and 20DMA have become support on a intra-day and closing basis. Continued impulsing to the upside should continue to use these MAs for support.

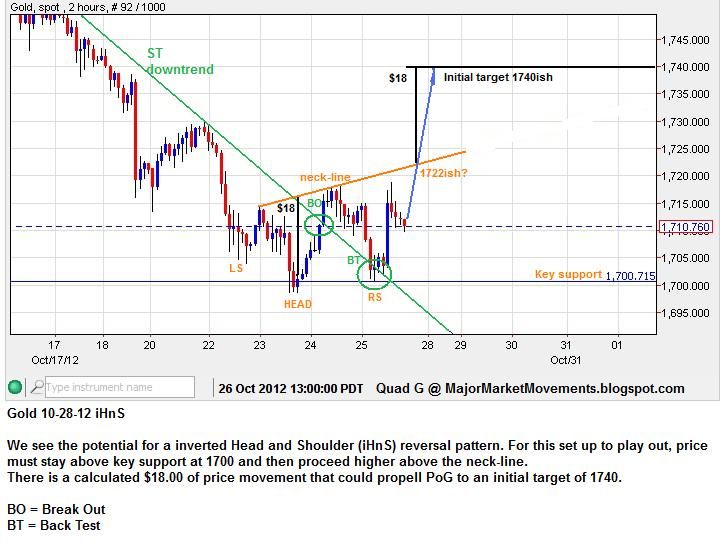

The ST Elliot Wave (EW) count suggests a 'third of a third' 'point of recognition' could be underway. Key support for such a move is 1734.80.

------------------------------------------------------------------------------------

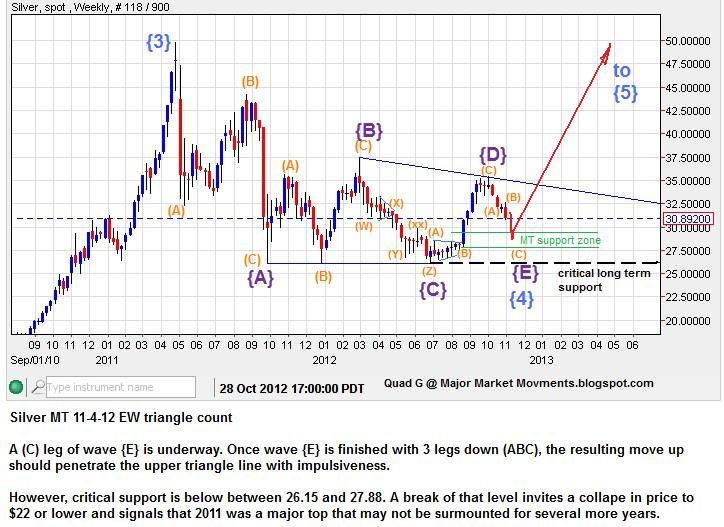

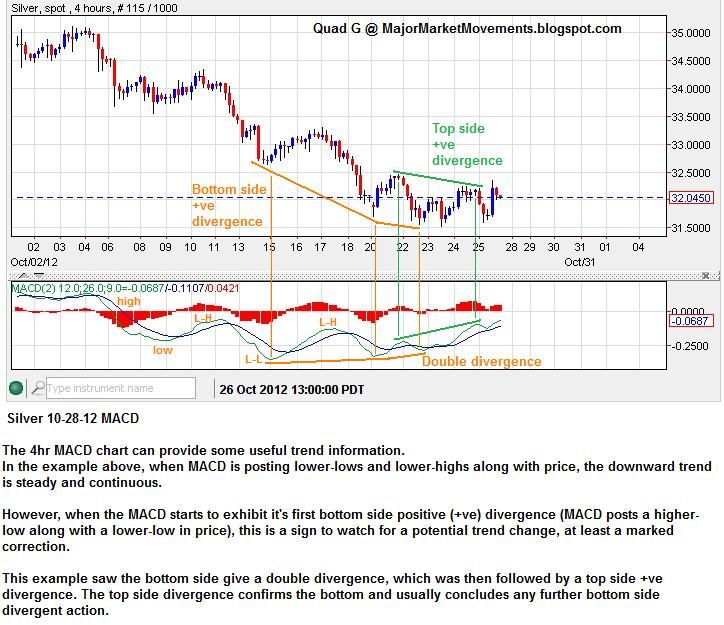

Silver - Last week I posted that if 33.00 was breached a pop up to 35+ was likely. Here is the reasoning for the target:

The 3/10/20 ribbon is also 'Wide-Open' for silver, an indication of impulsive action.

------------------------------------------------------------------------------------

USD - I suggested last week that a top could be in place, a resultant slide took place this week. It's possible that a significant right shoulder of a bearish HnS could be finished. A break of the neckline near 78.80ish could create a tumble down to 73ish as an initial target.

------------------------------------------------------------------------------------

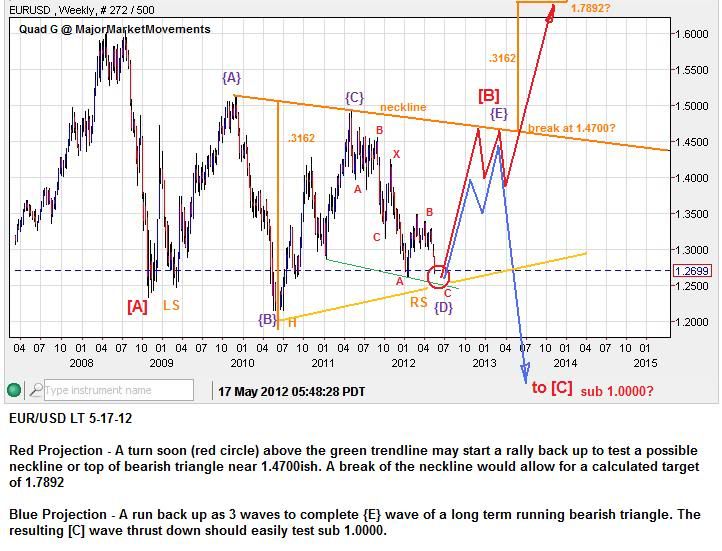

EUR/USD - I posted this chart back in May at Kitco. A bearish EW count mixed with a Bullish iHnS:

The Update adds an alternate bullish EW count. Critical Support for the Bull case is 1.2042, Critical Resistance for the Bear case is 1.4940. Both counts support an upward move over the next several weeks to test the upper triangle boundary.

------------------------------------------------------------------------------------

Coffee - I've been looking for some bottoming action is this market for some time. We may have seen it last week with a gap up and Break-Out (BO) followed by a choppy downward Back-Test (BT) and back-fill of the previous gap up. Price and volume are at odds, thus printing a +ve divergence.

If 145 holds as support, I suspect that an upward move will test ST and MT resistive trend-lines above. Long term horizontal support is around 150ish. CoT data also suggests Coffee is in a long term over-sold condition.

------------------------------------------------------------------------------------

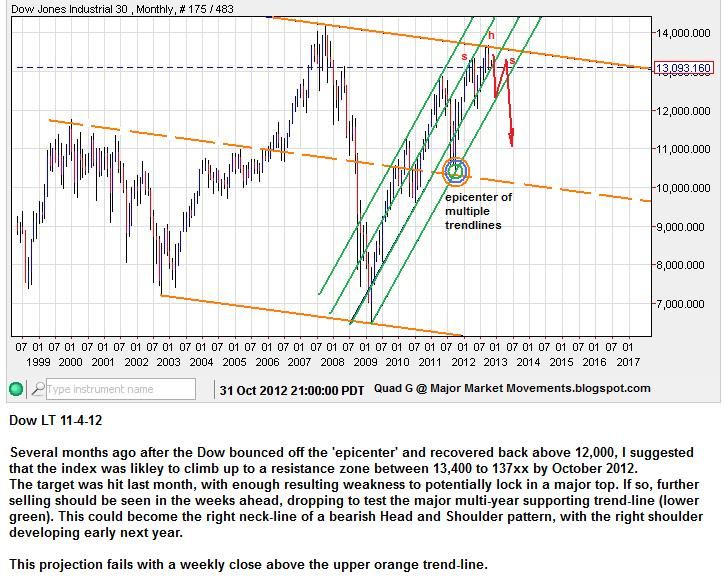

Dow - Broke above key ST resistance at 12,744 so the previous ST count is dead. Key ST resistance this week is 13,040, just a few points higher.

------------------------------------------------------------------------------------

Palladium - Key support moved up to 630.

Platinum - on a breakout last week, key support moved up to 1585.

Copper - Key support at 3.49

------------------------------------------------------------------------------------

A few of you expressed your support for my work here on this blog. Your gestures are certainly noticed and appreciated, Thanks.