Mornin' All!

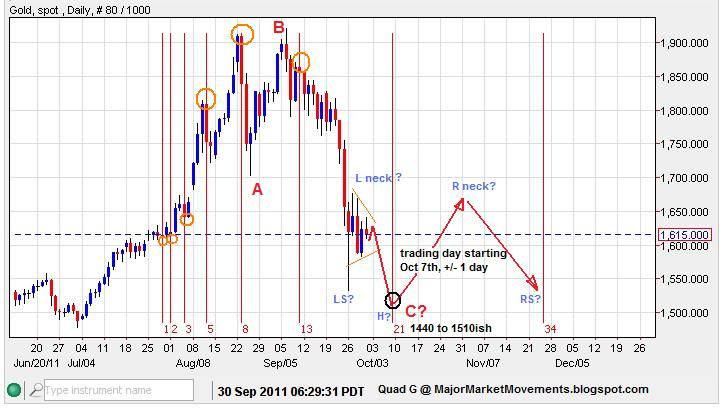

Gold - This should be it's own article but for the sake of time I'm gonna cram it in here. First let's look at a potential triangle/thrust bottoming pattern:

The current ST triangle is fairly mature and could be finished soon with a 3 leg wave (e) up. The resulting 5 wave series to the downside should be a final thrust to a bottom. Then price action should rebound back up into the price territory of the triangle, possibly into a right neck. If Key Resistance (KR) is taken out at 1640, then the triangle, at least as I have it drawn, is incorrect. If Critical Resistance (CR) is taken out then the triangle pattern is dead.

Zooming out and adding a time fibo measure we see that a potential exists for a turn near the trading day starting on Oct. 7th (which is actually 5pm on Oct. 6th).

Zooming out even further to a longer term view, a major source of support is clustered near 1440ish to 1510ish. Now that the 12% to 15% degree of correction area is busted, the 25 to 38% correction zone should be considered. The top of that zone is 1440:

I suspect that this larger correction is part of a 4th wave. I will present an updated EW count that I have in my head at a later time.

Dow - Time for a guessing game! Which one of these Dead Cat Bounces happened in 2008 and which one happened in 2011?

Hint #1: Both of these DCBs occur in roughly the same price area.

Hint #2: Both of these DCBs occur in roughly the same time period but 3 years apart.

Hint #3: The DCB in 2008 eventually led to an almost 28% collapse in the Dow within 8 days.

Hint #4: the Current DCBs top is 11,716 in 2011.

Good Hunting......

...

Dedicated to the pursuit of identifying significant turns and trends in multiple markets using the Elliot Wave Theory, Japanese Candlesticks, Cycles, Seasonals and basic technical analysis.

Friday, September 30, 2011

Wednesday, September 28, 2011

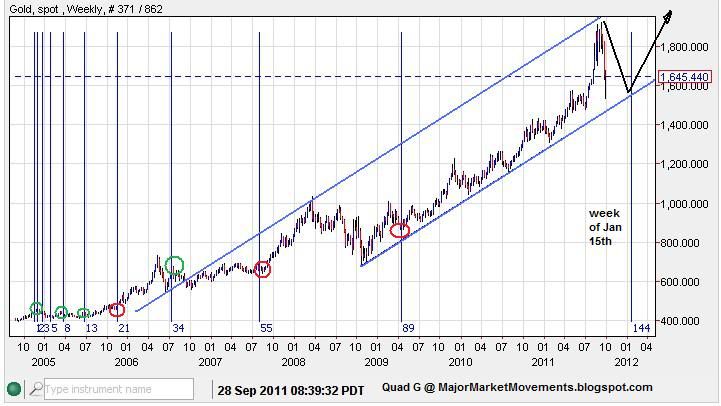

Gold - A review of Fibonacci time measures and turns....before and after.

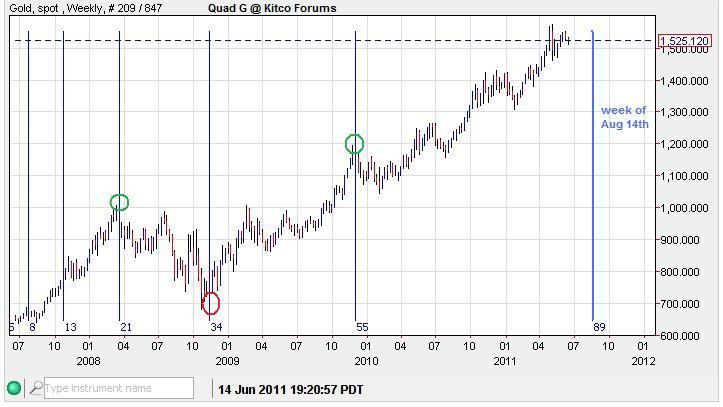

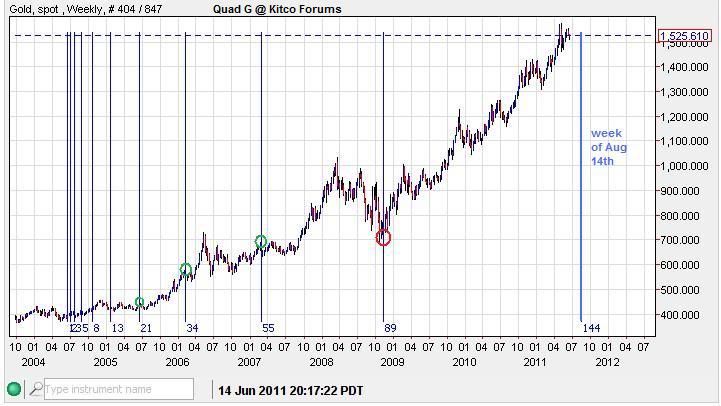

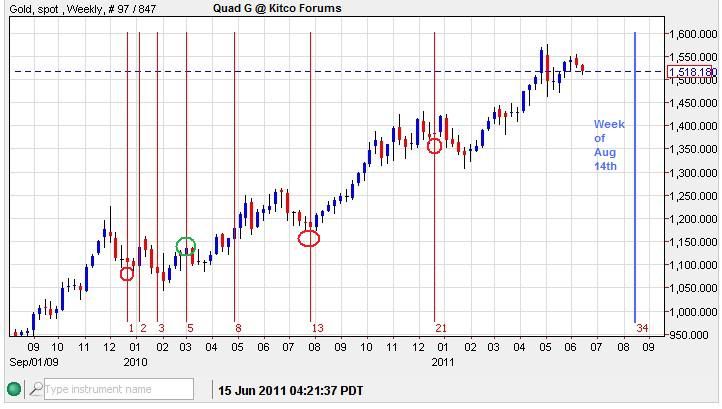

Let's review the Time Fibos that I posted back in June (at Kitco) showing a significant turn week of August 14th and the turn day of August 18th.

Here are the older charts:

As the week of the 14th came closer, some daily fibo alignments became apparent and pointed to a turn date window of August 18th +/- 1 trading day:

This is a relatively large cluster of time fibos that have pointed to the same time period, thus it's significance was likely to be just as large. Originally I was looking for a trend down or sideways into that date, so that a larger rally would erupt. However, as you will see in a moment the trend moved strongly up into the turn window. This could mean only one thing, that a significant top was likely to form for at least several weeks.

Here is the updated outcome so far:

The trend was certainly up into these turn date windows, so the resulting trend is certainly down for at least several weeks if not months. This is very likely to invert the cycle that I was originally looking at. Since we saw an August high instead of a low, the high what I was looking for in January '12 may actually be a low.

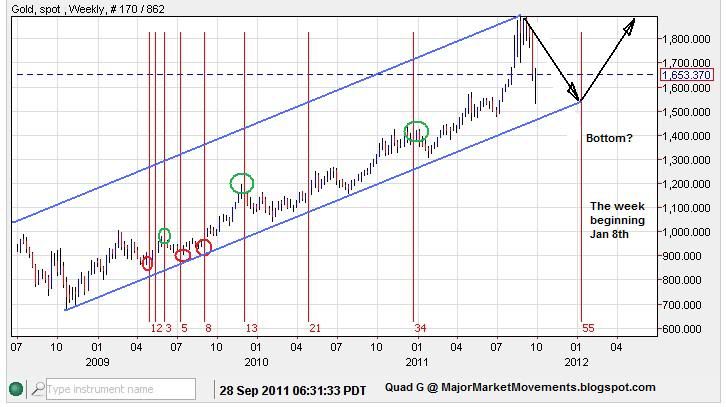

Here is a new set of weekly time fibos that roughly point to a time period between the last week of December and the second week of January:

If PoG can stay within the long term up channel (blue) over the next few months into the late December to mid-January time frame, moving in a choppy sideways manner, I think another major bottom could be produced for another large surge higher into 2012. As time approaches this weekly span, I will be able to use the Time fibo tool in the daily time frame to perhaps nail down a more specific turn date. It should be noted that a major Bradley turn date is set for December 28th also.

...

Here are the older charts:

As the week of the 14th came closer, some daily fibo alignments became apparent and pointed to a turn date window of August 18th +/- 1 trading day:

This is a relatively large cluster of time fibos that have pointed to the same time period, thus it's significance was likely to be just as large. Originally I was looking for a trend down or sideways into that date, so that a larger rally would erupt. However, as you will see in a moment the trend moved strongly up into the turn window. This could mean only one thing, that a significant top was likely to form for at least several weeks.

Here is the updated outcome so far:

The trend was certainly up into these turn date windows, so the resulting trend is certainly down for at least several weeks if not months. This is very likely to invert the cycle that I was originally looking at. Since we saw an August high instead of a low, the high what I was looking for in January '12 may actually be a low.

Here is a new set of weekly time fibos that roughly point to a time period between the last week of December and the second week of January:

If PoG can stay within the long term up channel (blue) over the next few months into the late December to mid-January time frame, moving in a choppy sideways manner, I think another major bottom could be produced for another large surge higher into 2012. As time approaches this weekly span, I will be able to use the Time fibo tool in the daily time frame to perhaps nail down a more specific turn date. It should be noted that a major Bradley turn date is set for December 28th also.

...

Labels:

Gold,

Time Fibos

Tuesday, September 27, 2011

Morning Coffee with Quad G - 9/27/11

Mornin' All,

Gold - The 4hr hammer candle that I mentioned yesterday seems to have done the trick and excited a rally back up into the Bollinger Bands just as anticipated. Closed 3 days under the BBs then popping back up through on the 4th, text book BB theory for Gold. Keep in mind that nothing is certain, but in the great majority of cases this theory is true for Gold and the stock market, Silver less so.

I think the most volatile move is over. Gold may now firm up a bottom over the next couple weeks. Another downward move looks likely into October, but not sure if it will be a lower-low or higher-low compared to the 1532 bottom yesterday. The Wave count is a bit messy, but at least one more wave down looks possible while PoG remains below the 10EMA on a daily closing basis (currently 1727 and falling). Again I reiterate, bulls want to see PoG remain above 1614 by the end of the week, to avoid a bearish OKR on the monthly chart.

Silver - Basically in lock step with Gold, seeing a bounce off a 4hr hammer candle from a very oversold condition. It too is under pressure while below the 10EMA and a lower-low is possible in October. But as long as Silver remains inside the blue base channel that I charted, chances are good that a major bottom could be finished soon, and a new rally may begin, at least a wave B up. This correction is on the same scale as the 2008 correction. The 2008 correction was sharp in nature, So this correction could be irregular, but spread out over much more time. There is also the possibility that this move down from $50 is the handle of a large 30+ year Cup and Handle formation. I will chart these thoughts soon.

Dow - Looks like we are going to see some end of the quarter window dressing, a little 'lip-stick on the pig'. After fund managers were caught with their pants down in July, they are likely to use any reserve cash to run the market up before the end of the month so that paying customers will see a better end result. A Little POMO action is also helping things along. If they can push the Dow up above 11,550 this week my bearish HnS pattern that I have pointed out will be killed, which could spark and even great short cover rally. But come October 1st after the quarter is all painted up nice and pretty, we may see the very same fund managers climb over the top of each other on their way to the exits. Resistance to the upside exists at the 10EMA (11,104) and the 20DMA (11,256).

The DAX (German Stock Market) gave a gap up this morning that has yet to fill. They have a few hours left to trade, let's see if they close it in a hurry. If they do fill it today, it signals a possible exhaustion gap which is bearish. We may also see the Dow give an exhaustion gap up this AM.

BAC - Popped above ST resistance yesterday at 6.50, the next significant level is 6.80 which was the previous break-down level. This rally could be just a back-test of that break-down before heading lower. However if BAC can surmount 6.80 then all bets are off, much further upside very possible.

USD - Not behaving as previously anticipated. Key support is at 77.51. Currently we are seeing a small bounce off the 10EMA level at 77.60. The 3/10/20 ribbon is still bullish but will likely enter a neutral alignment if USD closes the day below the 10EMA. Either way, for a long side bet the risk is fairly minimal at this point with stops under 77.51.

I wanted to get this out quickly, I may come back later and fill this article in with charts a bit later in the morning.

All the Best.....

...

Gold - The 4hr hammer candle that I mentioned yesterday seems to have done the trick and excited a rally back up into the Bollinger Bands just as anticipated. Closed 3 days under the BBs then popping back up through on the 4th, text book BB theory for Gold. Keep in mind that nothing is certain, but in the great majority of cases this theory is true for Gold and the stock market, Silver less so.

I think the most volatile move is over. Gold may now firm up a bottom over the next couple weeks. Another downward move looks likely into October, but not sure if it will be a lower-low or higher-low compared to the 1532 bottom yesterday. The Wave count is a bit messy, but at least one more wave down looks possible while PoG remains below the 10EMA on a daily closing basis (currently 1727 and falling). Again I reiterate, bulls want to see PoG remain above 1614 by the end of the week, to avoid a bearish OKR on the monthly chart.

Silver - Basically in lock step with Gold, seeing a bounce off a 4hr hammer candle from a very oversold condition. It too is under pressure while below the 10EMA and a lower-low is possible in October. But as long as Silver remains inside the blue base channel that I charted, chances are good that a major bottom could be finished soon, and a new rally may begin, at least a wave B up. This correction is on the same scale as the 2008 correction. The 2008 correction was sharp in nature, So this correction could be irregular, but spread out over much more time. There is also the possibility that this move down from $50 is the handle of a large 30+ year Cup and Handle formation. I will chart these thoughts soon.

Dow - Looks like we are going to see some end of the quarter window dressing, a little 'lip-stick on the pig'. After fund managers were caught with their pants down in July, they are likely to use any reserve cash to run the market up before the end of the month so that paying customers will see a better end result. A Little POMO action is also helping things along. If they can push the Dow up above 11,550 this week my bearish HnS pattern that I have pointed out will be killed, which could spark and even great short cover rally. But come October 1st after the quarter is all painted up nice and pretty, we may see the very same fund managers climb over the top of each other on their way to the exits. Resistance to the upside exists at the 10EMA (11,104) and the 20DMA (11,256).

The DAX (German Stock Market) gave a gap up this morning that has yet to fill. They have a few hours left to trade, let's see if they close it in a hurry. If they do fill it today, it signals a possible exhaustion gap which is bearish. We may also see the Dow give an exhaustion gap up this AM.

BAC - Popped above ST resistance yesterday at 6.50, the next significant level is 6.80 which was the previous break-down level. This rally could be just a back-test of that break-down before heading lower. However if BAC can surmount 6.80 then all bets are off, much further upside very possible.

USD - Not behaving as previously anticipated. Key support is at 77.51. Currently we are seeing a small bounce off the 10EMA level at 77.60. The 3/10/20 ribbon is still bullish but will likely enter a neutral alignment if USD closes the day below the 10EMA. Either way, for a long side bet the risk is fairly minimal at this point with stops under 77.51.

I wanted to get this out quickly, I may come back later and fill this article in with charts a bit later in the morning.

All the Best.....

...

MMM Weekly Round Table Discussion 9/27/11 to 10/2/11

This 'Thread' is for your comments and questions during this week.

There is a hot link for this section on the top of the side bar to the right.

The blog is experiencing even more traffic. Now up into the 4,000 views a day territory. Thanks all for the support!

...

There is a hot link for this section on the top of the side bar to the right.

The blog is experiencing even more traffic. Now up into the 4,000 views a day territory. Thanks all for the support!

...

Labels:

Round Table

Monday, September 26, 2011

Morning Coffee with Quad G - 9/26/11

Mornin' All,

Silver - Has moved into a support cluster near the 25 to 27 price range and has so far managed a ST impulse up, producing a 4hr bullish hammer candle. This could give us a bounce out of an oversold condition at the least:

4hr reversal candle:

ST 5 wave impulse off the bottom and bull flag:

If this early morning move up is part of a significant bottom, a sharp impulsive drive should move PoS to above the upper blue base channel line. If not, then it's more likely a 3 wave ABC correction to the upside and another wave down could be next to do some more bottom searching.

Dow - A Third of a Third 'point of recognition' to the downside is possible very soon:

This projection is dead if the Dow moves above 11,550 (Critical Resistance, CR)

USD - My previous count suggested that USD should be working on a 3rd wave up. However, the action so far has not given the appropriate impulsive attitude. I can see a possible ending diagonal. A move below 77.52 would likely confirm the ending diagonal and deny the 3rd wave impulse to the upside.

30 year Bond - Also looks like it could be working on a weakening top. Key support in price is at 142. Falling below that level suggests the bond market may have placed a significant top.

Good Hunting All,

...

Silver - Has moved into a support cluster near the 25 to 27 price range and has so far managed a ST impulse up, producing a 4hr bullish hammer candle. This could give us a bounce out of an oversold condition at the least:

4hr reversal candle:

ST 5 wave impulse off the bottom and bull flag:

If this early morning move up is part of a significant bottom, a sharp impulsive drive should move PoS to above the upper blue base channel line. If not, then it's more likely a 3 wave ABC correction to the upside and another wave down could be next to do some more bottom searching.

Dow - A Third of a Third 'point of recognition' to the downside is possible very soon:

This projection is dead if the Dow moves above 11,550 (Critical Resistance, CR)

USD - My previous count suggested that USD should be working on a 3rd wave up. However, the action so far has not given the appropriate impulsive attitude. I can see a possible ending diagonal. A move below 77.52 would likely confirm the ending diagonal and deny the 3rd wave impulse to the upside.

30 year Bond - Also looks like it could be working on a weakening top. Key support in price is at 142. Falling below that level suggests the bond market may have placed a significant top.

Good Hunting All,

...

Sunday, September 25, 2011

Gold - Update 9/25/11

Many charts this weekend, much to consider because of last week's move. There is a fairly tight grouping of support that I'll show first:

Previous charts have shown an increasing parabolic rise in supporting trend-lines. The foremost line is one to watch, which is near 1578 this week:

Gold has also produced a fairly consistent stair step in price from which investors have risked 2-3% above the previous step. Another test of the last step is likely underway. If investors are still in the mood to buy, they should be willing to risk another 1-3% above the previous step, providing a risk window of 1575 to 1622:

I have shown the long standing support at the 150DMA for the past couple years, which has now moved steadily upward to a support level of 1577:

Looking at the MT EW count Wave (4)green can be counted as an irregular expanded flat which is filling in most of the 12-15% correction window for this degree of correction, same for wave(2) green. The bottom of the 15% range is at 1625ish:

There is also a serious danger to further MT upside that could become obvious next week. If the Month of September closes below the Opening price in August (1614.76), a very bearish Outside Key Reversal (OKR) will be printed. The same occurred in 2008 which was followed by a 34% major correction for 7 months from the 1032 top in March 2008. Such a move would be a major sell signal for many investors. An intra-month fall through 1614.76 is acceptable this week, but the month MUST close above 1614.76, friday the 30th to avoid this bearish signal. Here is the chart:

The action on Friday did see an end of day bounce after filling in a very thinly traded area between between 1632 and 1638, then finished the day back above the sloping trend-line connecting the previous 2 ST bottoms. This shows that there is some degree of buying interest at these levels:

Also, Friday closed the day about $55 below the lower Bollinger Band (BB). This was the second day of closing below the band. One more day is possible on Monday, then chances are very good that price will rise back into the BBs again for at least a ST bounce. The 3/10/20 clearly in a bearish alignment and will remain that way with daily closes below the 10EMA (currently 1770):

A weekly time fibo points to next week as a possible bottom. This would coincide with options expiry, futures expiry, a new moon and a minor Bradley turn date on the 26th:

The daily time fibo also shows a potential turn early this week. A dead cat bounce as a minimum. Daily fibo turns are given +/- 1 day of window, end of day Monday the 26th should close the window:

In A Nut Shell:

I suspect that PoG will see a bounce early next week back up into the BBs 1700ish from a support zone of 1614 to 1643. Then a retest of those lows looks possible in the first or second week of October. A group of significant support exists between 1575 and 1590. If this zone of support is broken below 1575, then a major top has likely formed, one which may take several months for PoG to surmount after dropping even further (1200s would be possible). This would also kill the MT EW count and prospects of a major parabolic run into the first quarter of 2012.

I will work on my Silver report next. I will get to your questions and comments as soon as I am able.

...

Previous charts have shown an increasing parabolic rise in supporting trend-lines. The foremost line is one to watch, which is near 1578 this week:

Gold has also produced a fairly consistent stair step in price from which investors have risked 2-3% above the previous step. Another test of the last step is likely underway. If investors are still in the mood to buy, they should be willing to risk another 1-3% above the previous step, providing a risk window of 1575 to 1622:

I have shown the long standing support at the 150DMA for the past couple years, which has now moved steadily upward to a support level of 1577:

Looking at the MT EW count Wave (4)green can be counted as an irregular expanded flat which is filling in most of the 12-15% correction window for this degree of correction, same for wave(2) green. The bottom of the 15% range is at 1625ish:

There is also a serious danger to further MT upside that could become obvious next week. If the Month of September closes below the Opening price in August (1614.76), a very bearish Outside Key Reversal (OKR) will be printed. The same occurred in 2008 which was followed by a 34% major correction for 7 months from the 1032 top in March 2008. Such a move would be a major sell signal for many investors. An intra-month fall through 1614.76 is acceptable this week, but the month MUST close above 1614.76, friday the 30th to avoid this bearish signal. Here is the chart:

The action on Friday did see an end of day bounce after filling in a very thinly traded area between between 1632 and 1638, then finished the day back above the sloping trend-line connecting the previous 2 ST bottoms. This shows that there is some degree of buying interest at these levels:

Also, Friday closed the day about $55 below the lower Bollinger Band (BB). This was the second day of closing below the band. One more day is possible on Monday, then chances are very good that price will rise back into the BBs again for at least a ST bounce. The 3/10/20 clearly in a bearish alignment and will remain that way with daily closes below the 10EMA (currently 1770):

A weekly time fibo points to next week as a possible bottom. This would coincide with options expiry, futures expiry, a new moon and a minor Bradley turn date on the 26th:

The daily time fibo also shows a potential turn early this week. A dead cat bounce as a minimum. Daily fibo turns are given +/- 1 day of window, end of day Monday the 26th should close the window:

In A Nut Shell:

I suspect that PoG will see a bounce early next week back up into the BBs 1700ish from a support zone of 1614 to 1643. Then a retest of those lows looks possible in the first or second week of October. A group of significant support exists between 1575 and 1590. If this zone of support is broken below 1575, then a major top has likely formed, one which may take several months for PoG to surmount after dropping even further (1200s would be possible). This would also kill the MT EW count and prospects of a major parabolic run into the first quarter of 2012.

I will work on my Silver report next. I will get to your questions and comments as soon as I am able.

...

Friday, September 23, 2011

MMM Epic Fail Alert - Gold and Silver 9/23/11

Epic Fail in Gold and Silver! My analysis is obviously incorrect. Gold down to 1684, silver down to 32.25. At this point regard all my previous counts and analysis as null and void, except for the 3/10/20 ribbon at this time.

The currency markets are not responding in kind with this move in Gold and Silver, so the move is likely fear based capitulation on the part of long side investors.

However, Stocks, Crude, Copper, Palladium, USD, and cross pairs EUR, GBP, AUD and CAD all moving as anticipated, as the deflationary juggernaut that I warned of has crashed through the door. Gold and Silver are now added to the victims list.

...

The currency markets are not responding in kind with this move in Gold and Silver, so the move is likely fear based capitulation on the part of long side investors.

However, Stocks, Crude, Copper, Palladium, USD, and cross pairs EUR, GBP, AUD and CAD all moving as anticipated, as the deflationary juggernaut that I warned of has crashed through the door. Gold and Silver are now added to the victims list.

...

Subscribe to:

Posts (Atom)