I performed a Time Fibo sweep for dates coming up in the near future. 3 interesting weekly turns point to a span of time between the week opening April 14th to the week opening April 28th. Weekly turns can get us in the ball park, but daily time fibos can fine tune the turn inside the weekly span. The daily turns point to a span of time between April 23rd to the 24th. A full-moon is also on the 25th. Those series of dates are right in the middle of the weekly alignments. So, a trend down into that 23rd to 24th window would suggest a bottom turn, a trend up into that turn date window would suggest a top. With a fairly large compilation of alignments, I would have to say that the turn date window should have a very noticeable MT reaction. I suspect that most of April could remain range bound between 1540 and 1620, but the month of May could see a significant trend develop, I think the trend will be bullish if price can stay above 1540.

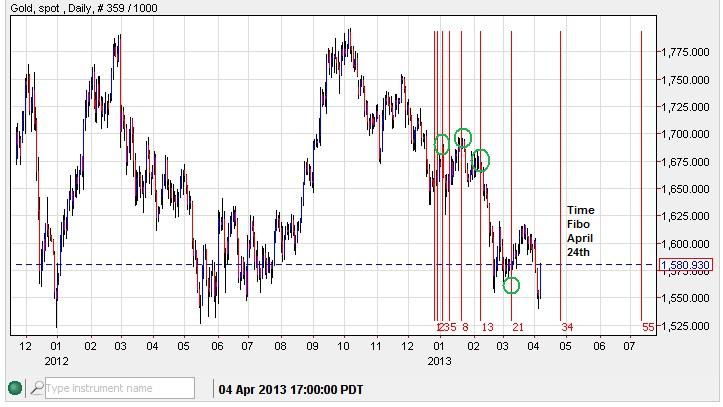

Weekly Time Fibo Alignments:

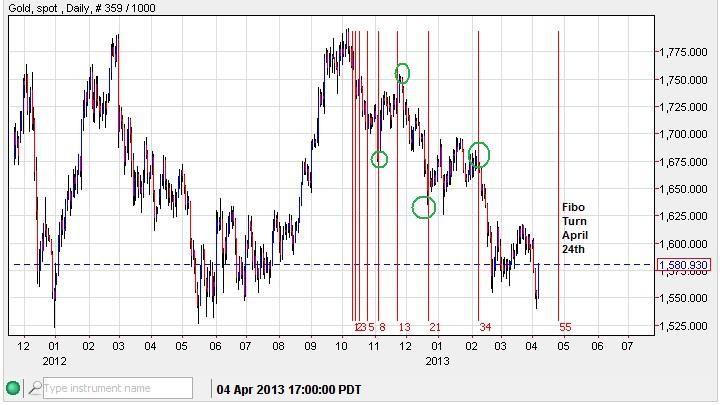

Daily Time Fibo Alignments:

ST Elliot wave potential:

If the Elliot wave pattern plays out, it could set up a bullish iHnS projection:

Last week's daily candle stick pattern was also bullish:

-----------------------------------------------------------------------------------------------------------

USD - A bearish inverted hammer was printed last week, setting up critical resistance at 83.49

-----------------------------------------------------------------------------------------------------------

USD/JPY - Provided an excellent buying opportunity, but could be getting toppy soon.

-----------------------------------------------------------------------------------------------------------

S&P500 - logged in a bearish topping candle last week on the daily, trend would be bearish while under 1573.66

-----------------------------------------------------------------------------------------------------------

Good Hunting this week,

QG