This week's update shows the breach of the neckline (blue) with follow-through up to the resistance zone. In the days ahead we could see the price wrestle with this zone as well as challenge the MT 38.2% fibo retrace level at 1415ish.

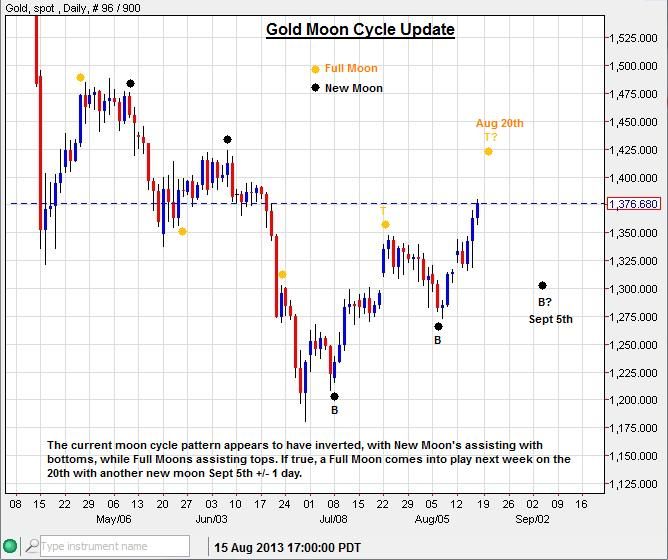

The Moon cycle has nailed a few tops and bottoms recently. Next week, there is another full moon on Aug 20th providing a turn date window between the close on Aug 19th to the close on Aug 22nd. The last full moon helped cap a top, this iteration may be no different. If a top is realized next week, another bottom may come into play the next new moon on Sept 5th.

The last New Moon turn date window (Aug 5th to Aug 8th) kept me on watch for potential bottoming action, found some:

The previous weekly bullish hammer candle saw some substantial follow-through last week:

I suspect that gold could hit some resistance this week, perhaps digesting some of the previous gains before moving higher while remaining above key ST support levels.

----------------------------------------------------------------------------------------------------------------------------------

Silver - Cut right through a resistance zone like a hot knife through butter. Though this bullish stampede has been amazing, it has been seen before. In 2008 a 2 week 34+% rise was seen, no doubt churning the bullish juices. However, Silver and most other asset classes were caught up in the post Lehman deflationary romp with the ensuing stock market collapse after Sept 15th, 2008.

I'm not interested in throwing a wet blanket on the current euphoria, but I find that it's good practice to temper such enthusiasm with some sober judgement.

Silver bulls have also left a 'mess behind', taking off with out giving the NY market a chance at the 20.51 to 20.86 level. That could be hit later.

-------------------------------------------------------------------------------------------------------------------------------

NUGT - Has played very well lately, riding up (about 100% return in just a few weeks) as expected from the long term support channel and bottom in the HUI gold miner index (currently 271ish):

Update:

------------------------------------------------------------------------------------------------------------------------------

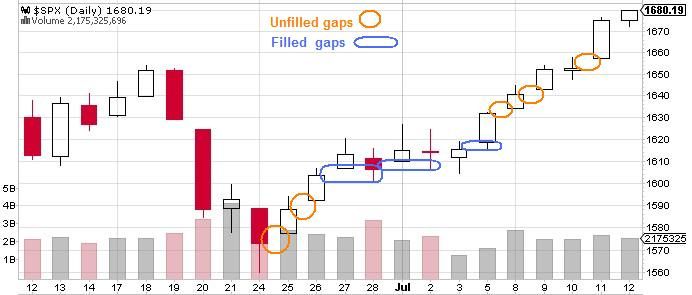

Stock Market - Has been acting 'toppy' for a couple weeks now. Here is some previous analysis that pointed out that the current run up was not likely going to last with out a meaningful correction.

From July 21st:

From July 14th:

The stock market action the last several days was showing that a top was increasingly likely:

----------------------------------------------------------------------------------------------------------------------------

If you are a trader interested in technical pattern recognition for managing trades, consider subscribing to my daily email service here:

http://majormarketmovements.blogspot.com/p/mmm-market-signal.html

Good Hunting this week,

Quad G