Hello All! I caught a break and decided to furnish an update on my favorite markets - Gold and Silver. Life for me has changed significantly, for the better. However, in so doing, I don't have the time for this blog or other pursuits. I'll chime in from time to time, but such visits will likely be few, far between and limited in scope.

The blogging experience has been enjoyable. I can see that with all the content I would like to deliver, this endeavor could easily become a full time gig to do it right. However at this time, I have much more important and meaningful duties that demand my attention.

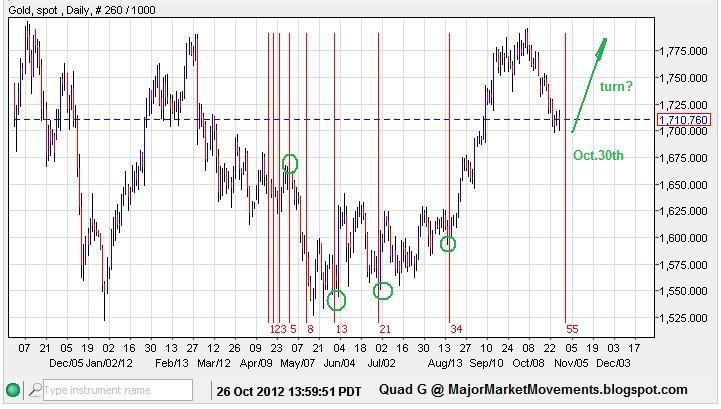

Gold - This latest sell-off was well anticipated. Using the technical tools that I have taught on these pages most certainly indicated a turn and coming weakness.

First the Fibonacci Time measurements did another terrific job! Spot on again!

The turn dates that I have mentioned previously Nov. 10th and Dec. 8th-9th both produced highs. Using the Fibonacci Time Zone tool on NetDania here is how I derived the two turn dates, it's easy to do, try it yourself.

Nov 10th:

Dec. 8th-9th:

Having worked with this tool for a few months I have established a some rules:

1) Must measure off at least TWO previous turns, the more turns that are connected the better the result.

2) A trend of at least 7 trading days must move up or down into the turn date.

3) The turn can be the top of the trend or back test of the trend.

4) Daily measures are generally less significant in strength than weekly. Measured turns on a daily chart may only produce a trend that lasts a few weeks, while measures on the weekly chart could initiate trends that last months.

5) Dates must be given a window of +/- 1 trading day.

I also noticed that the Nov. 10th and Dec. 8th turns fell on or near Full Moons, with Dec. 8th being a rare lunar eclipse. This may have influenced the strength of the turn dates. Recognition goes to Antimagnetic for his previous eclipse work and it's affects on the Gold market.

Another Fibo date I recently measured in the daily time frame is on the horizon:

Dec. 28th:

The 28th also coincides with a weekly fibo turn date that pointed to the last week of December. This could be a good place in time to watch for a potential major bottom.

I have also taught the 3/10/20 ribbon and Japanese candle sticks. If these two were being watched, a bearish warning would have been observed:

A channel line analysis also displayed bearish trouble:

Also a bearish Head and Shoulder pattern suggesting a top was near, giving a potential initial target of 1534:

With this information I sold some of my gold stack near the Nov. 10th date and the Dec. 8th date, averaging out between 1750 and 1800. I will now be looking to load up some silver on this dip over the next few weeks. I previously mentioned that I was looking for the GSR (Gold to Silver Ratio) to make a move higher toward 57-60. we reached 55.60ish on a intra-day basis yesterday. If the ratio stays above 52.37, I think the 57 to 60 zone could be reached soon:

Once 52.37 is broken, I think the top of the GSR with be locked in and the journey toward 16 will begin. Silver will obviously be the better performer, thus the reason that I am selling some of my gold stack to buoy the silver stack at this high GSR.

I think Gold could move down a bit more, possibly making a lower-low below 1532. I suspect that this correction is a large degree similar to 2008, but only a 4th wave. If PoG recovers impulsively back above 1666 anytime soon, I think a bottom could be locked in.

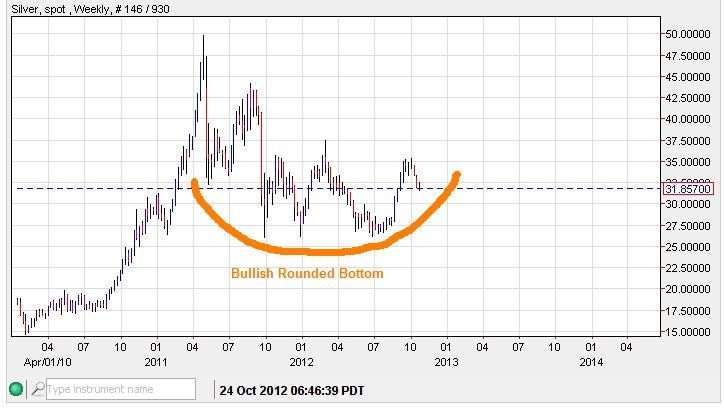

Silver - I think Silver could slip further to test 25ish and potentially 22. But at this time, if Silver recovers back above 33.70, I think a MT bottom will be locked in.

My long term view still has not changed: Gold to 2400+ and silver to 95+ possibly inside the next 8 months. I think this current move down is just pulling back the sling shot with 1920 gold and 50 silver as the pivot.

I also want to put in a plug for NetDania.com. They now have a fantastic smart phone app that is absolutely phenomenal. Go check it out!

Time has run out, gotta go. I am not 'back' by any means. I'll post again when I am able, but might be a few weeks. All the best to you! DYODD.

...