I know it's not morning in the states right now, but it's morning somewhere!

Much to cover today. Some of these charts were prepped yesterday but didn't have the time to post.

Dow - Not much has changed so far. The tops that I called recently are still good and the mid-channel that I mentioned is still holding as resistance:

The blue dashed line is what I call a mid-fork. It's often a point of resistance or support inside a larger channel. We are certainly seeing that line providing resistance.

I recently called two tops in the Dow and explained briefly why. Here is a chart to better explain:

The back to back gravestone dojis is a good ST indicator of topping action. And then a 5 wave move up to an incremental high (no break-out) is also suggesting a top.

That 5 wave move was also back-testing the previous channel that was broken to the downside:

Then yesterday and today we see the Dow attempting a 3rd time to break resistance:

Be wary of a potential 'fake out' today or tomorrow. That probability will likely die with a move below 11,430. The gap at 11,140 and the lower orange trend-line may give some support. I didn't mark it on the chart, but if that support holds and a 4th attempt is made to the upside and breaks the higher orange trend-line, then the 'rule of 4' would suggest that such a move will likely break out strongly to the upside. However, a solid break of that lower orange trend line and 11,104 should keep the selling moving along strongly.

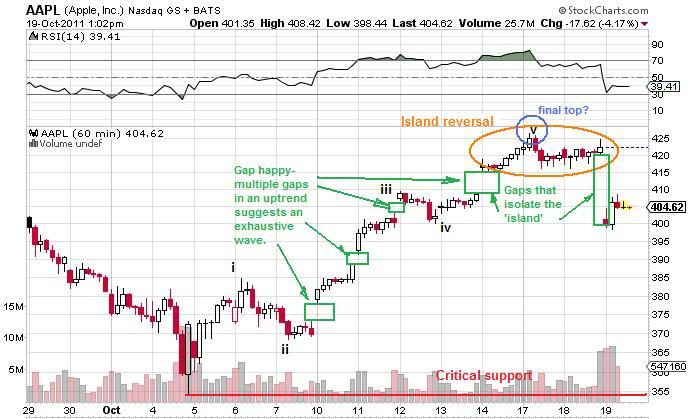

AAPL (Apple Inc.) I suggested that one may want to 'sell the news' on AAPL. Their numbers were strong but they still 'missed' guidance, investors are unforgiving. In the wake, AAPL has put in an 'Island Reversal' at the end of a 'gap happy' streak, often a very strong reversal pattern:

IBM also displaying some topping action:

Overall, the market is looking close to confirming another significant turn, Dow down impulsively another 100pts since I started this post.

Silver - Close to filling out a convincing triangle wave {iv} with a wave {v} down to come which is likely a final fifth:

If this triangle is complete, then Key Support (KS) should be taken out soon, inviting a final thrust to the downside. The end of a final fifth would likely give an excellent buying opportunity, preferably $25ish. I think Gold will likely follow silver down and challenge 1500-1510, with an off chance at 1440ish. I would like to see the GSR (Gold/Silver ratio) not exceed 60ish. If Key resistance is exceeded (33.05), then the triangle denies the dowside potenial and allows for a move up to 36+.

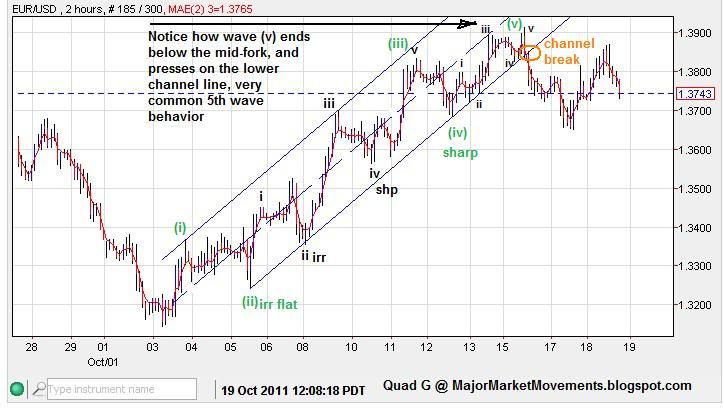

Euro - And the USD, Displayed some good structure indicating a turn, Here is how it looked at the Euro end:

First clue was an (OKR) in the 2hr time frame at the end of a 5 wave structure on the back side of a trend-line that was once support but now resistance.......all coming together to suggest a top, at least ST, was likely.

Then the 4hr time frame added to the signal:

EW counting suggests a 5th wave is finished, a well formed 5 wave impulse, text book example:

The daily BBs were also provinding resistance:

And the larger picture shows the move was inside the multi-month support/resistance zone:

Using mutiple tools at the same time can help hone in on market turns.

Key resistance for the Euro is now at 1.3914. The move down so far could be corrective or something more substantial, not sure yet, but the move looks somewhat choppy. A move below 1.3440 would likely lock in the current top at 1.3914.

...