'What was once Support is now Resistance'.

I've mentioned before how $33.50 to $34 was critical support for continued uptrend and that a break of that level invited a move into the 20s. Now that it's firmly established as fact, that same critical support has now become resistance, take a look:

S/R zone #2 is the current area that silver is struggling to overcome, along with the upper blue channel line. If this resistance continues to hold, another drop is possible into S/R zone #3 (24.90 to 26.38) red projection. A lazy drop and hugging the upper channel line would promote bottoming action. If however, S/R zone #2 fails to contain price action (blue projection) then a shot up to zone #3 could be in the works (36.92 to 38.95).

Zooming out we see a larger trend that may also affect price:

The mid-forks of the larger orange base channel (which is blue in previous charts) is also adding to resistance, but the lower channel lines may provide support if another drop were to occur. Moving below the lower orange channel line (green projection) especially in an impulsive fashion, would be very bearish and could set up a challenge of long term support at $21 to $22.

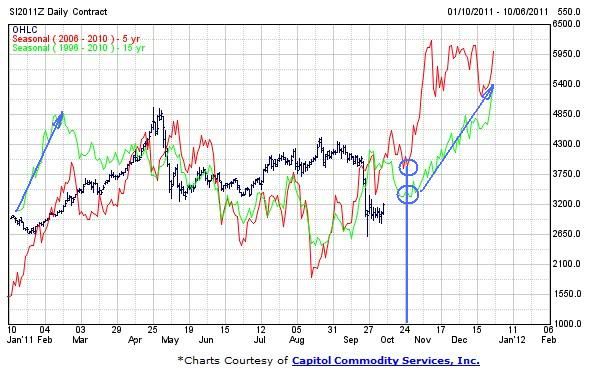

Looking at the seasonal chart, another secondary low comes into play near the end of the month, from which bullish seasonality should help silver climb higher or soften any further downside:

Ultimately I would like to see silver stay above 24.90, gold stay above 1500 and see the GSR remain under below 58 to 60. If pattern, price and time match up by the end of the year, I think another major low will be in place and a surge back up to challenge 50+ again will be likely.

...