http://majormarketmovements.blogspot.com/2013/06/mmm-weekend-update-6-9-13.html

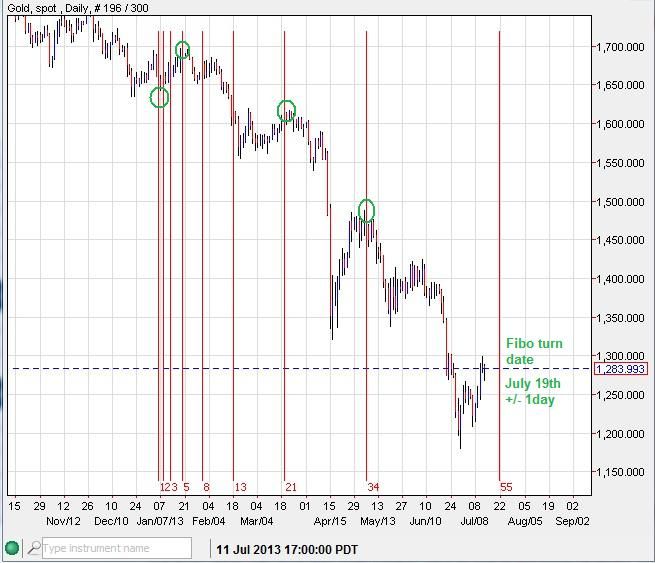

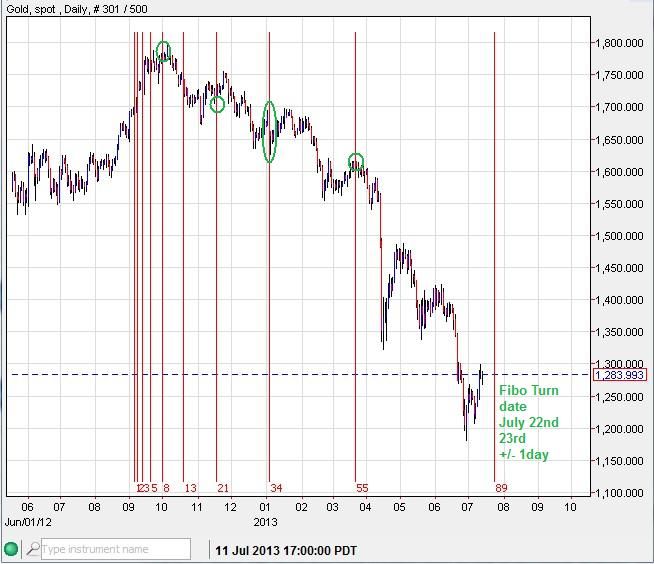

But even 1-2 weeks is not a very effective range to trade. Now that we are on the threshold of the Fibo turn week, I can use the daily time fibo tool to help narrow down the turn to with in a few days. Most daily measures point to July 18th and July 19th +/- 1 day, with an outside chance of July 22nd to 23rd. The Full moon also present on July 22nd. The current ST trend is so far going up into these dates, while the MT trend is down. It is possible that the ST trend could reverse early this week and start heading back down into the turn dates. This condition would be most welcome for finding a significant bottom. If the ST trend continues to march upward into this turn date window, then it will make the cycle and wave structure a little more complicated.

The July 18th- 19th +/- 1day turn date window would span the close on July 17th to the open on the 23rd as non-trading day weekends are not counted. So if the ST trend moves down into this time frame, it increases the likelihood that a bottom will be realized. If however, the current ST trend moves up into this time frame, the chances increase for a significant top.

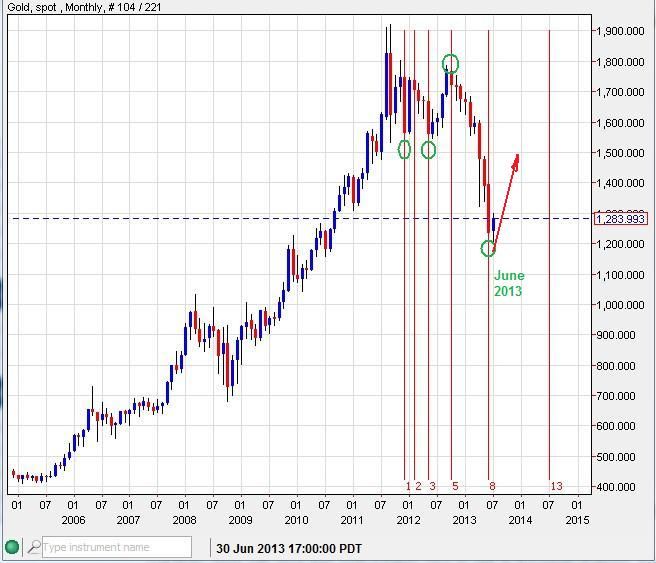

I also did some new monthly time fibo measures that I have not typically done, but wish I had. Multiple measures point to a Bottom in June! Could it be that the bottom is already in, and the July Weekly turn is just a higher-low? Could be, judge for yourself.

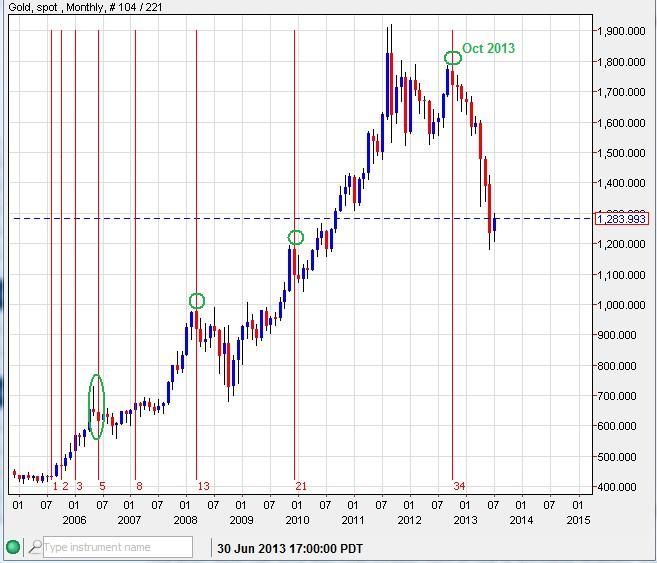

Now you might be thinking - "Quad, seriously, monthly 'time fibos' what kinda techno-hokum is that?!?!" Well, all I can say is, I wish I would have been paying more attention to them last October, as a the measures lined up perfectly for a top:

Here is one additional weekly time fibo measure:

And now the daily time fibo measures:

Here are a couple ST EW counts that could account for a higher-low, which would respect that June bottom and a lower-low that would violate the June bottom (1180.20) but most likely only 1-3% lower. Both counts have key support/resistance levels of 1267.92, 1298.89 and 1337.94. If the price exceeds 1337.94 before any bottom is printed, then the MT EW count changes, as this would be a wave (i)/(iv) violation:

Now I seriously doubt that FED chairman Bernanke fills his day-planner using time fibos. But I do find is extraordinarily uncanny that he is scheduled to testify this coming July 17th and 18th. Talk about coincidence.

---------------------------------------------------------------------------------------------------------------------------------

Silver - Will likely bottom (or top) roughly the same time as gold. Here is what that price action could look like as a bottom moving down into the fibo turn date window:

--------------------------------------------------------------------------------------------------------------------------------

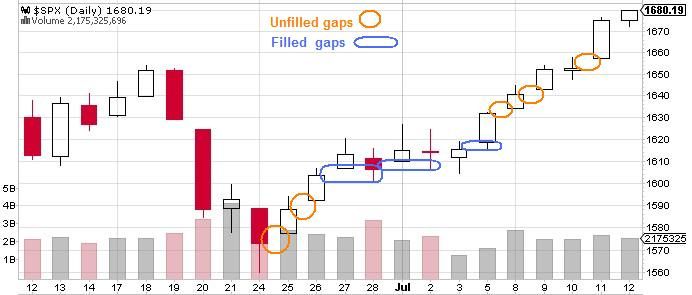

The S&P500 has been shooting up rapidly, no doubt fueled by some short covering as key resistance levels were popped. However, the trail left behind is problematic, as multiple gaps up leave a mess behind. The markets may seem chaotic at times, but they are usually very good at 'cleaning' up their messes after the party is over. So I fully expect that this 'gap happy' run will exhaust itself and fall back to fill in these gaps left behind.

Strong, organized up-trends that methodically inch up day by day generally have the fortitude to last much longer:

-------------------------------------------------------------------------------------------------------------------------------

There are a plethora of different technical tools that can help guide a trader to make decisions. Having learned many of them, I have isolated the few tools that generally give the highest probabilities of producing tops and bottoms. If you are interested in receiving as well as learning about these valuable tools, you may subscribe to my daily email updates here:

http://majormarketmovements.blogspot.com/p/mmm-market-signal.html

Good Hunting,

QG