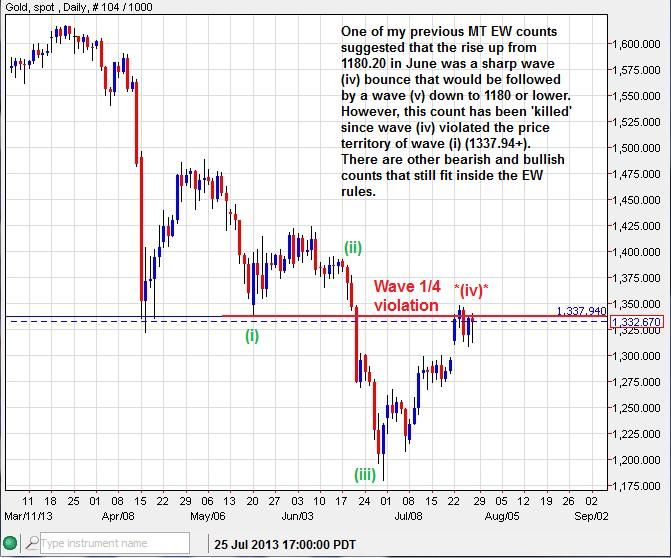

Here is an EW ST update:

The primary count suggests that the Full-moon top will hold and a 3 wave pull-back toward the next new moon could be seen over the next several trading days. The alternative (:colon) is far more bullish, but has some hurdles to jump over before coming into favor.

An iHnS pattern, highly 'skewed,' measured for a rough top fairly well. If the top holds, the Break-out of the neckline and even the neckline itself could get a back-test soon.

The New York market is the top dog of all the markets around the world. Seldom does a price move extend beyond NYs attention for very long. I typically gauge the NY market to be between the hours of 8am to 5pm EST. This is the span of time that the NY marketeers holds their chance to influence the gold market for the daily session. When the price moves through territory that NY has not had a chance to weigh in on, the tendency is for the market to eventually correct back into that price territory that I dub the NY 'dead space' during the NY time frame. NY doesn't like to be kept 'out of the loop'. So when you see an over night move run into new price territory, either up or down, know that the probabilities favor a return to that price territory later on during the NY hours.

Here is an example:

As you can see the over-night market made a big splash one day, leaving a void or Dead Zone that eventually was filled during NY hours. It looks as though NY has been comfortable with its new range now for a few days.

I recently spotted for my subscribers a ST top in Gold's price at 1347ish after observing a 4hr time scale 'hairy top':

---------------------------------------------------------------------------------------------------------------------------------

Silver - Not looking as hot as gold or GDX, leaving the whole PM complex in a quandary going into next week. The weekly closed as a bearish inverted hammer candle, setting key resistance at 20.60:

Weekly candles can often be responsible for moves that last at least a couple weeks, this would suggest that further selling is likely while below 20.60. If 20.60 is breached then another short squeeze could be realized.

The Silver EW count has a bullish and bearish option, both with their own unique set of qualifiers.

---------------------------------------------------------------------------------------------------------------------------------

GDX - The miners have produced a Rule of 4 (Ro4) breach to the upside, with price currently riding above the break-out line. The oscillators RSI and MACD have also moved above some key levels. The MACD has moved above its zero line for the first time in months. And the RSI has moved above its 60 line. This all suggests that this market is in recovery. Even if this market was to fall again to a lower-low, I see it as another gift of a buying opportunity for the next MT bull run.

For now, in the ST, GDX is tangling with the resistance posed by the previous congestion zone.

----------------------------------------------------------------------------------------------------------------------------------

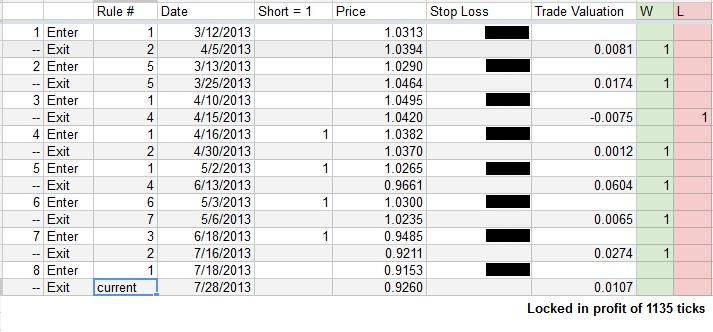

AUD/USD - Has a full count to the downside and is working on rolling out into a recovery:

The price has also performed a Break-out and Back-test, this market is poised to move upward while above .9128

The Long term chart shows that price has come down to back-test an old break-out line inside a previous congestion support zone:

My QG3 trading method has produced some excellent results in this market since I took on the Aussie back in March. So far there has been about 1135 ticks of profit that have been locked in. One contract with an initial margin of $2,013 would have profited about $11,350 in just a few months (minus roll-over and broker fees).

Much of which was due to the QG3 signaling subscribers to get in on the short side of this 'major market movement', keeping them in for most of the way down:

The QG3 trading method has now signaled to get prepared for the possibly of a long side advance.

If you are a trader and would like to receive my daily market updates, you may sign up here:

http://majormarketmovements.blogspot.com/p/mmm-market-signal.html

All the best to you this week,

Quad G