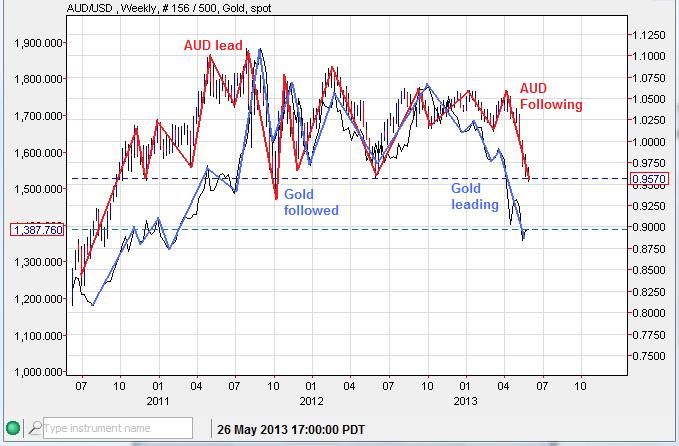

The Australian Dollar (red) and Gold (blue) have paired up nicely, sometimes switching lead roles with each other. Currently Gold has lead the way down, with the Aussie lagging behind but catching up quickly:

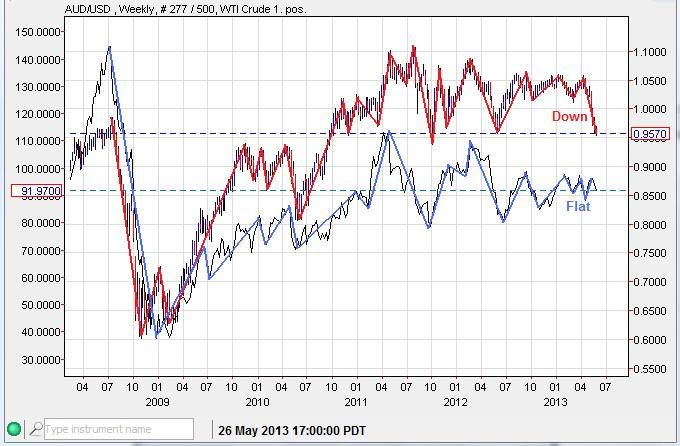

The Aussie/Crude (WTI) has also enjoyed close company, except the recent plunge in AUD (red) has not yet been reflected in the price of Crude (blue) which has drawn flat in recent weeks:

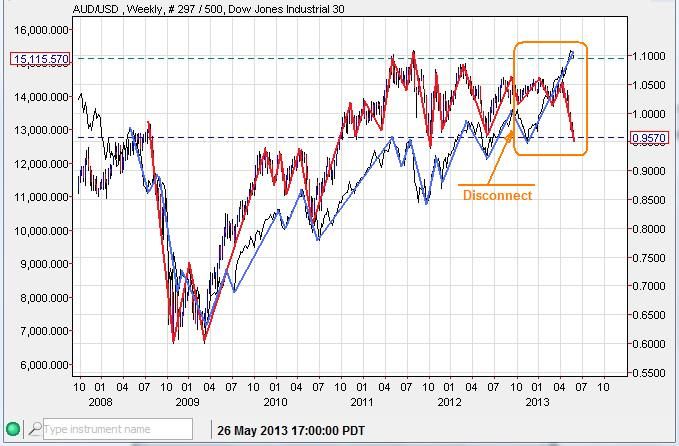

The largest AUD (red) divergence is with the Dow (blue). The stock market has continued skyward, while the Aussie has collapsed:

I suspect that one of these markets in particular is lying, showing a strong face but weak in the knees (The Dow). Perhaps the tremendous Yen intervention by the BoJ has caused the currency markets to temporarily disconnect from their old paradigms. Either way, something is amiss and will likely see a correction soon. I think the Aussie is like a canary in a coal mine, it's either going to choke on the fumes of toxic monetary intervention or has some how died of natural causes (which I highly doubt). The Australian economy is a chief exporter of raw materials and energy to the Eastern and Western economies. Generally a fall in the value of AUD, signals that export demand is shrinking, AUD denominated raw materials and energy ceases to be bid up, reducing demand for the Aussie, thus it's value. Most likely an indication of yet another global economic slow down.

We'll see. Crude Oil is the fence sitter, a leap into bull or bear territory in the weeks ahead, breaking out of it's current consolidation, should make the forth coming trend obvious as to it's next MT direction.

---------------------------------------------------------------------------------------------------------------------------------------

BDI - Baltic Dry Index. Has been a bellwether of global economic activity, From the top in 2007, the index has been looking for a major bottom along with the global economy. The current triangle/thrust pattern and choppy movement above a mid-channel line suggests that the BDI may have at least one more shot down to finalize a bottom in the months ahead, likely unwinding any of the last long side speculation. A Rule of 4 (Ro4) breach above the descending channel (green) should confirm a bottom.

--------------------------------------------------------------------------------------------------------------------------------------

30 Year Bond - The 'Long' bond has had a very consistent 30 year peak-to-trough cycle well into the 1800s. The last trough in price (peak in yield)was in 1981, here it is 32 years later and a peak is due (low in yield). I suspect that major FED involvement (quantitative easing) has caused this 30 year cycle to extend to some degree. However, I doubt that the FED will be able to hold off this cycle much longer. Those that have paid attention to my blog know that I have been hunting for a major top in the Bond market for a few years now. The most recent activity has been giving clues that another potential major top is in place. The action could be that of a stealthy roll-over, with a wash-down soon to be realized, but must keep under 150.00.

As global credit markets continue to be hit by the profligate financial maneuverings of central banks and nations, the US long bond will either be the last life boat in the credit market or go down with the ship. Time is not on it's side according to the 30 year cycle.

Good Hunting Folks,

Quad G

If you would care to receive my daily email updates on market conditions, you may sign up for a free 15 day trial here:

http://majormarketmovements.blogspot.com/p/mmm-market-signal.html