I now favor a ST count in the Stock Market and it's not pretty. The count is good, but the outcome is potentially disastrous.

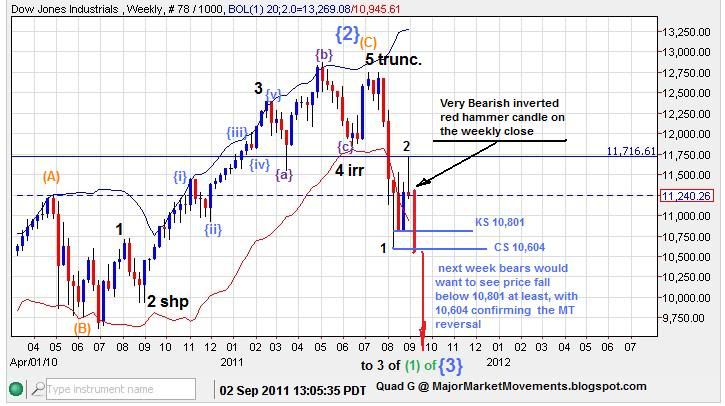

Here is the ST view:

The Dow came up as a (c) wave right into a tight pocket of resistance from various angles. The rejection from that resistance was certainly pronounced as witnessed today. The 3/10/20 ribbon is still in a MT Bullish alignment by just a few points. The Price today found support at the 20 DMA, closing just above it. Next week the daily closes will need to move below the 20DMA to drag the 3/10/20 into a MT bearish alignment.

The Weekly chart posts a very bearish candle stick that I suggested might happen:

The red inverted hammer candle on a weekly chart is very foreboding. This candle has likely locked in the top at 11,716 this week. This would be the base from which to gage further risk with short positions. A 3rd wave down is possible with my preferred EW count. Measures suggest a minimum target of 9560, with an ideal target range from 8240 to 8920. All possible before the end of September. The action needs to be sure and swift to the downside next week, taking out Key Support at 10,801 and Critical Support at 10,604.

If the Dow instead respects the support at 10,800ish and proceeds to produce a sideways consolidation above that level, then this bearish projection could be in jeopardy and a move thereafter above 11,716 would confirm it.

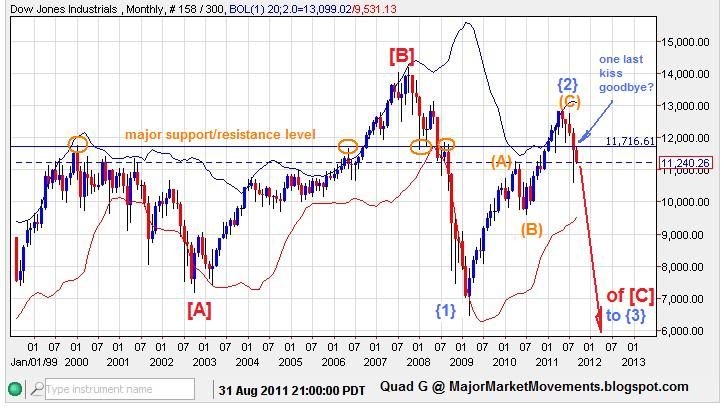

The Long Term chart shows another line of resistance near the 11,750 level set back in January 2000.

Perhaps this week's move up was a kiss goodbye.

The wave going down could be counted as a 3rd wave, {3} blue, which is often the strongest of the impulse waves (1st, 3rd and 5th). The corrections may be very short and small from this point forward. The movement is likely to be in a stair step fashion: 2 steps down, 1 step up, 2 steps down, 1 step up, progressing toward a final bottom in 2015 to 2016.

This is an extremely bearish count, there are others that are less severe, but I am currently favoring this one until proven other wise.

...