Mornin' All,

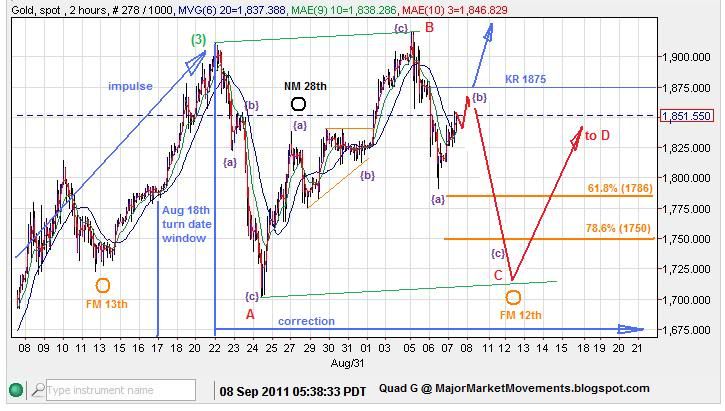

Gold - Here is a potential outcome to watch for if gold remains under 1875:

I still suspect that we are in a sideways corrective period from the August 18th turn date window. I see the potential for that correction to form as a running triangle. Wave B red extended just a bit, but reversed with a daily outside key reversal, denying a break-out. If we do indeed see a move down as wave {c} of (C) into the Full Moon (FM) date of Sept. 12th +/-1 trading day, I think it will set up a very good buying opportunity. This is but one possibility for a new irregular correction. Instead of a triangle, it could also form a running flat, or expanded flat. Each type of correction has it's own set of parameters. However, one thing is certain, if a triangle does in fact play out at this time, then it MUST be counted as a 4th wave and not a 2nd wave. A 2nd wave can in rare occasions BE PART of a triangle pattern but internal structure of the triangle is very key.

I mentioned this earlier but it deserves repeating: 'Sweet September' has 83% chance of ending higher than when it started. The month started at 1826.56, so any buys below that level have a 83% chance of being winners by the end of the month.

Silver - The outlook hasn't changed much. The move through 41.50 did confirm it's working on a correction still and not producing a new impulse to the upside. This set's up any move above 43.35 as a possible break-out point. 39.50 is still critical support, falling below that level invites a slide to the $36 range, with 36.85ish looking like fairly firm support. Again if 36.00 is broken to the downside, a trap door opening is possible, be careful.

Palladium - I have mentioned the possibility of palladium reacting bearishly to an end diagonal as a truncated 5th wave. Here is a chart that depicts what I have been referring to:

My previous palladium chart had a very bullish outcome, but the swift move down as a possible wave (i) green puts the bullish count in jeopardy and favors this far more bearish interpretation. This bear count will die with a move up beyond critical resistance at 846.75 and will likely be confirmed with a third wave move down below critical support at 678.

Since Palladium is mostly driven by industrial demand, a weakening global economy will severely hamper it's upside potential (the bullion market share is very small). The times that palladium has grown the most is during strong times in the stock market. If a severe stock market crash is ahead, then palladium is very likely to move down with it. The same picture looks probable for copper also. This bearish outlook could turn on a dime if the FED introduces another big round of easing to intervene in the market very soon.

Dow - Has moved up above 11,420 (61.8% fibo retrace) My bearish count is now in jeopardy, which is not death, but it's in trouble, with probabilities of failing increasing. There is a second gap left on friday that may want to be filled, the top of that gap is 11,492. My bearish count fails with a move above 11,716, so if the market is moving up soley to fill that gap, then a relatively low risk short could be entered near the 11,492 area, with stops above 11,716. If 11,716 is breached then the EW picture must be re-evaluated. The Dow could still be producing a dead cat bounce above 11,716. 11,862 is also a very key level, as what was support should now become resistance if this market is indeed bearish for the MT.

...