The last time I charted silver, the expectation was to see impulsive behavior up into a third wave, previous chart:

We did indeed recieve a bounce up to 43.35, but that bounce so far is still a lower-high and proceeded in 3 waves, NOT an impulse. Instead the market gave us a non-commital sideways move for the past couple weeks.

Here are some more signs of that neutrality:

The 3/10/20 ribbon, has turned from Bullish to neutral with the downward cross of the 3EMA under th 10 EMA on Friday. We also see that the market parked the week at the 20DMA, a sign of non-commitment for bulls and bears going into the weekend. The two day candle pattern almost produced a bearish outside key reversal but fell short by about 4 cents.

On the Weekly Chart, the candle pattern also shows neutrality, The two previous weeks almost mirror each other as polar opposites:

A trend-line analysis reveals more of the same, a tightening range of converging trend-lines that should eventually force traders to make a firm commitment to the next trend:

Price is still creeping inside an ascending channel (green), but sideways action continues to push price toward the lower green channel line to apply pressure to potentially cause a break down out of the channel.

Taking a closer look we see the potential of a bearish Head and Shoulder pattern (HnS):

40.33 and the lower orange trend-line (also the neckline) guard against a downward potential of $5.90 if the neckline is tripped soon. If the neckline is broken early next week at about 40.50ish, the potential downside target would be about 34.60ish. If However, another shot of Bullishness propels silver above key resistance at 43.35 (red) then the pattern changes to one of higher-highs and higher-lows, an up trend, likely killing the bearish HnS.

But what if the neckline trips initiating a strong downward sell. There is another line of support below at 36.85 to watch:

The 61.8% fibo retrace level and a multi-month lateral support/resistance level combine to provide a potential area of technical support.

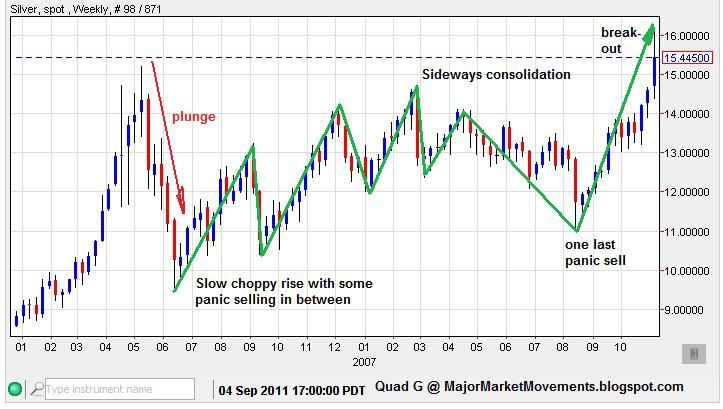

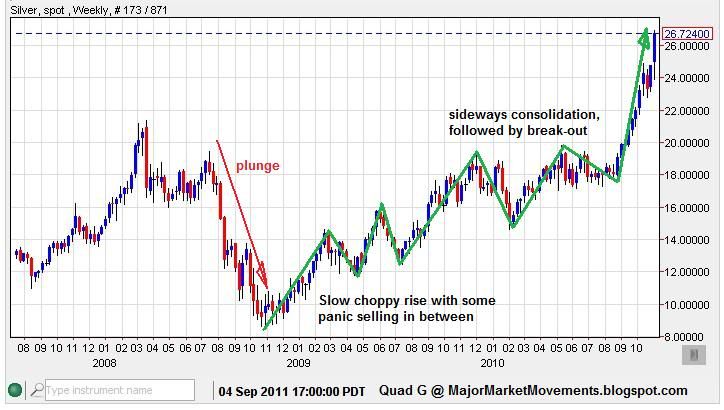

Also, keep in mind that many times before after a severe plunge in price, Silver has taken months crawling back up in a slow choppy fashion with panic drops in between. This current trend higher may also experience the same type of sell-offs from time to time until PoS enters a sideways consolidation period. Previous examples:

2004

2006

2008 to 2010

So a panic drop in the days to come may actually be part of SOP (Standard Operating Procedure). However, I would say that any fall below 34.00 would put any further MT upside in serious jeopardy.

All the Best,

QG

...