The Price of Gold in AUD (Australian Dollar) is nearing the end of a long term consolidation period in the form of a triangle. There may be many things 'Down-Under' in Australia, but Aussie Gold is about to go 'Up-Over'.

Here is the previous projection calling for a climb out of a major bottom at the end of wave (C), up into wave (D) to finish a 3 wave move higher (ABC):

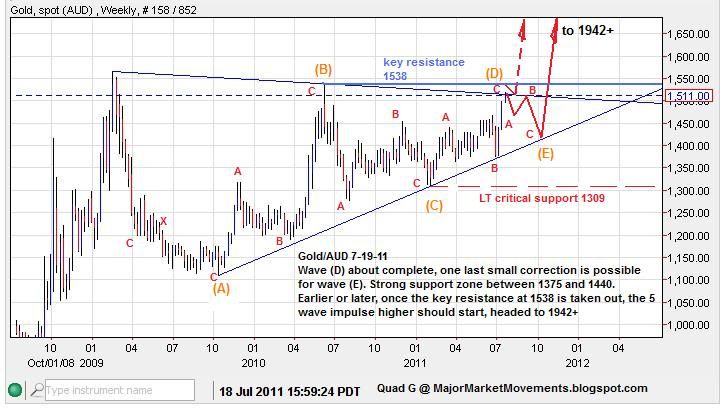

This is a current update showing a possibly completed Wave (D):

1538 is key resistance, 3 waves down to form wave (E) is expected, but price action needs to stay below 1538. A break of 1538 prematurely (dashed red arrow), could signal that the 5 wave impulse higher has already started. Wave E is likely to end at a strong support zone between 1375 and 1440 in the weeks ahead. Any move below critical LT support at 1309 kills this bullish triangle pattern.

Comparative studies versus other markets:

Gold-AUD compared to Gold-USD:

Gold-AUD compared to the Dow Jones Industrial Average (DJIA):

Gold-AUD compared to the United States Dollar index (USD):

In summary, Gold should be putting in a major bottom in the second half of 2011, with another thrust higher into 2012. Gold-USD and Gold - AUD are most likely to top in unison. The USD may move lower, but a significant rebound off lower-lows is possible, to meet with a topping Gold-AUD. The end of the rise in Gold-AUD may come from the end of a major stock market sell-off.

...