Palladium is a very interesting metal, not only can it filter hydrogen, but it also seems to gage with amazing accuracy the various changes to the US economy.

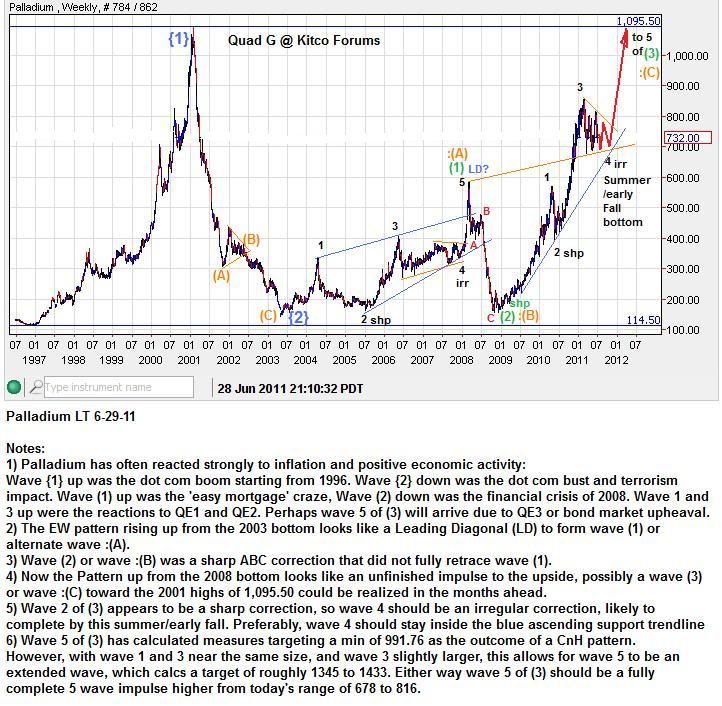

Here is a previous chart from late June:

As I noted back then:

Wave {1} (blue) originated from 1996, the beginnings of the Dot Com boom and just after the Clinton era changes to the Community Reinvestment Act.

Wave {2} (blue) marked the Dot Com bust and terrorism impact.

Wave (1) (green) Followed the 'easy mortgage' craze higher.

Wave (2) (green) dropped with the 2008 financial crisis.

Wave 1 and 3 of wave (3) clearly react to QE1 and QE2.

Wave 2 (black) coincided with the 2010 'flash crash'

Now at wave 4, an irregular correction, appears to fall in line with the indecision over the US debt ceiling.

Anticipating another advance up soon into wave 5 to test the all time high of 1095.50, perhaps the resolution to the Debt ceiling issue will usher in QE3 or a Bond market collapse/ or both. What ever happens, Palladium appears to be a steady meter of such events.

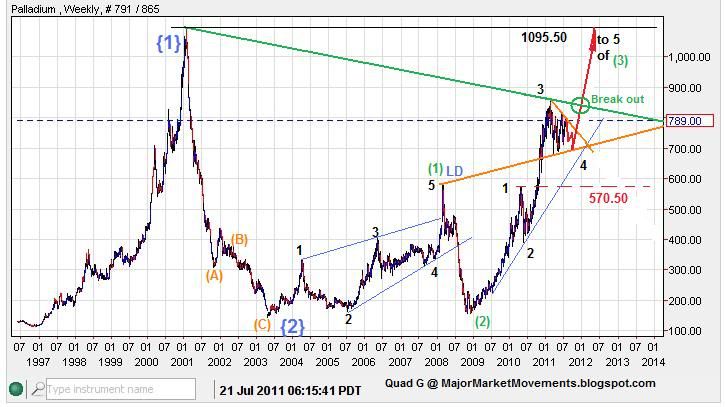

Here is an update for July 21st:

Wave 4 of (3) is still in it's irregular correction, However upon breaking out above the foremost descending multi-year trend-line (green), I suspect that wave 5 higher will be underway. This interpretation is in jeopardy if the blue supporting trend-line is broken (currently below at 625). This interpretation is incorrect (killed) if price falls below the level of wave 1 (570.50). This would cause an Elliot Wave rule violation called an over-lap, 4th waves are not allowed to enter the price territory of the previous 1st wave.

...