This is a good time to present my long term view of the silver market. A major low may have completed at 33.37 to finish

wave 4.

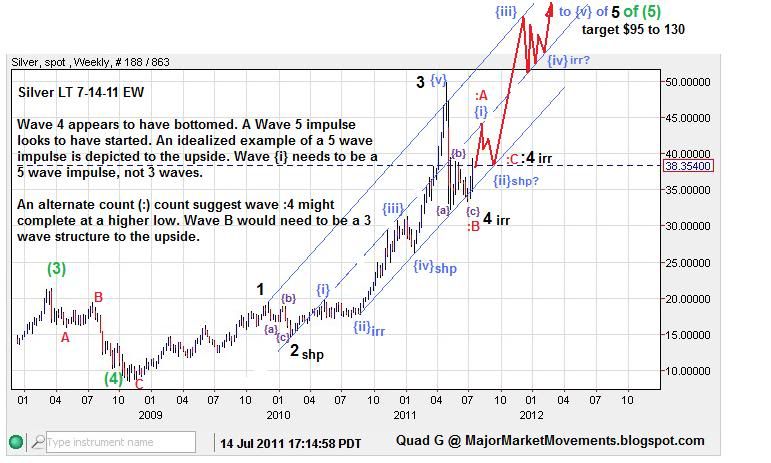

Here is the updated Long Term chart:

In order for wave 4 to be confirmed as complete, we need to see a 5 wave impulse to the upside in the short term to complete wave {i}. If a choppy 3 wave move to the upside is realized instead, then it must be counted as a corrective B wave as an alternate. B waves can NEVER be counted as a 5 wave structure, it would be a EW rule violation to do so.

Wave 5 up has the potential to breach the $50 level, then possibly back-test $50 as a small correction. Afterward PoS is likely to careen skyward into a 5th wave blow-off top. Some Fibo price relationships suggest that a target range of $95 to $130 can be reached. According to my LT count, this could be a major top for many years. However, what was once resistance, the $50 level, now and in 1980, could become support on any major correction afterward. So it is very possible (no guarantees) that the 33.37 low could be a very long term low that may never be seen again.

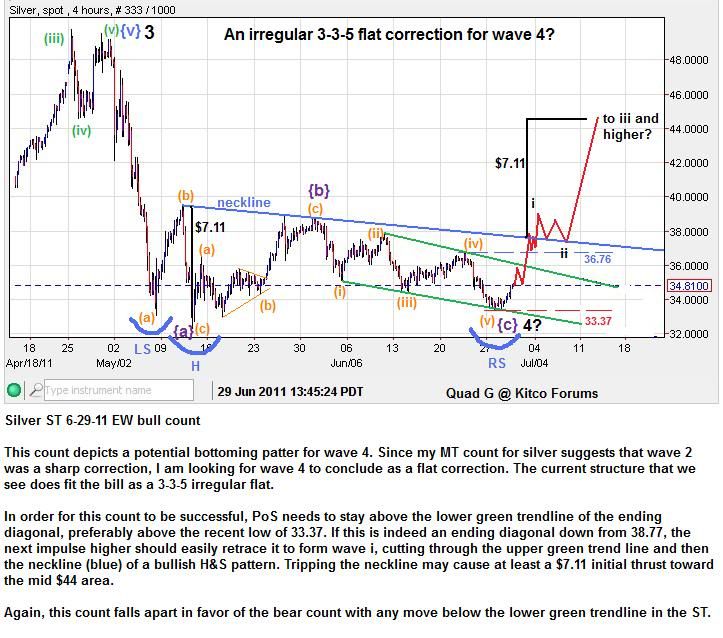

Now let's take a closer look at the action. Here is a recent call at the end of June for silver to start an impulse to the upside off the end of wave 4:

This count anticipated a 5 wave impulse to move up to break the blue neck-line of an iH&S, and quickly retrace the Ending Diagonal(ED) of wave {c} of 4. When an Ending Diagonal completes, it is text book EW for the ED to be eclipsed by an impulse in the opposite direction.

Here is the MT update:

The anticipation was meet very nicely! Silver did indeed start an impulsive series to the upside that broke the blue neck-line and fully retraced the ED. Price is currently encountering some resistance at the previous swing high around $39-$40.

I shall zoom in even closer to a ST count, this was posted back on July 5th:

I suspected that a 3rd of a 3rd, Point of Recognition (PoR)(green box) may be seen around the location of the blue neck-line, after a wave (i),(ii), i,ii count, with price easily exceeding $38.50 there after. The breach of the upper blue base channel line also strongly indicated the presence of 3rd wave impulsive action. 3rd waves are often a very strong if not the strongest impulse of a 5 wave series.

ST update 7/14/11:

$38.50 was exceeded. PoS clearly printed a PoR in the green box. Also note that the 3rd wave impulse busted through both base channels (blue and orange). Another clue that a strong 3rd of a 3rd impulse was very likely, is the fact that both wave (ii)green and wave ii black were both sharp corrections. If one or the other was an alternate irregular correction, then the upside potential could have been a bit more limited.

This current impulsive series to the upside may see an alternating irregular correction for wave iv black. Price action needs to stay above the wave i black top at $36.85 (dashed red). Critical support for ANY further upside potential is $33.37. There are likely enough protective sell orders below 33.37 to cause the price of Silver to move swiftly down into the 20s if 33.37 is broken.

Good Hunting...

QG