I have seen this count or similar counts with small variations from a few other Ellioticians. Some of my EW geek friends also ask me why I don't count the same way. Here is the count and why I don't see it the same:

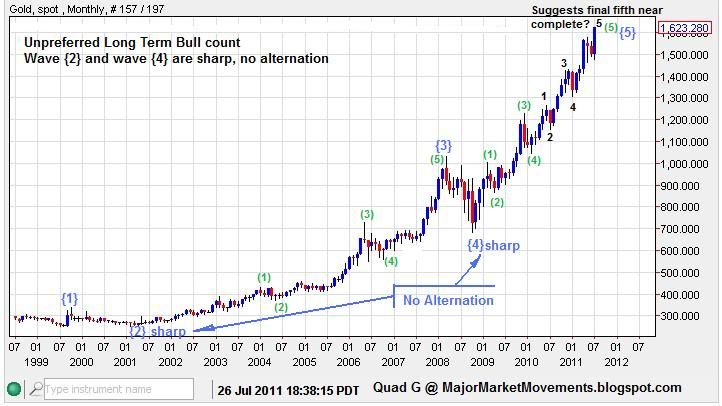

This is the entire bull run from the 1999 bottom:

Some Ellioticians see the 2008 low in Gold as the end of wave {4} blue. Yes indeed it is the end of a major bottom, however, counted this way leaves the count without alternation of waves {2} and {4} which both appear sharp in attitude.

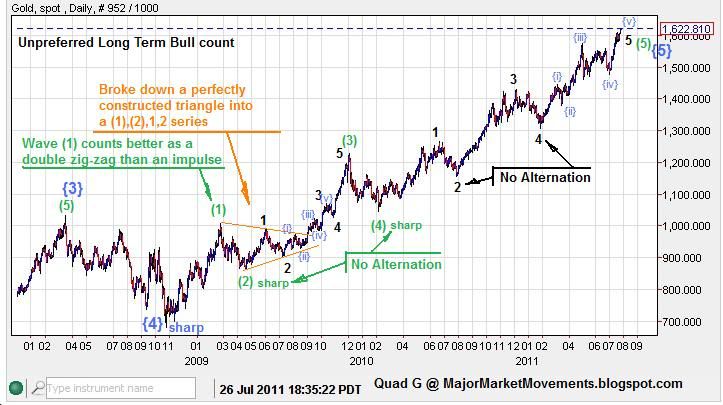

Taking a closer look I see more problems with this count:

What is commonly counted as wave (1) green, counts better as a wave (B) double-zig-zag, IMHO. Also, a perfectly good triangle is often ignored and chopped into a series of 1s and 2s. And further counting up the line often pays little attention to alternation.

As you can see, this count suggest that a final 5th wave, 5 of (5) of {5}, is done or about done. Such a count could point to a very great drop in the order of 25 to 38%. From today's highs that would target a range of 1218 to 1007 respectively. Every count is based on subjective interpretations, and every Elliotician is entitled to their opinion.

This count could be right, but I prefer another:

This interpretation eliminates the problems associated with the other count.

-- Wave {4} blue becomes an irregular flat, alternating with wave {2} blue.

-- The previous wave (1) green becomes a corrective wave (B) orange.

-- The triangle is counted better as an ABCDE correction to finish wave (C) of {4}.

-- Alternation is respected in subsequent counts up the chain.

-- Since wave (1) is counted off the end of the triangle (941ish), this leaves room in the count for at least one more 5th wave higher as wave (5) green.

There are certainly far more bullish counts than this one, I recognize that. And if those counts become clearly apparent then I will adopt them, all in due course.

Currently, I see a confluence of ST counts wrestling with the end of wave (3) green and the end of wave (4)green. 1660 should be a key level in determining which phase we are in. Keeping below suggests another 8-12% correction is possible. Moving above 1660 would likely cancel any significant near term corrections. Either way, the larger trend still should carry PoG much higher soon into wave (5) toward 2000 to 2450 in 2012.

...