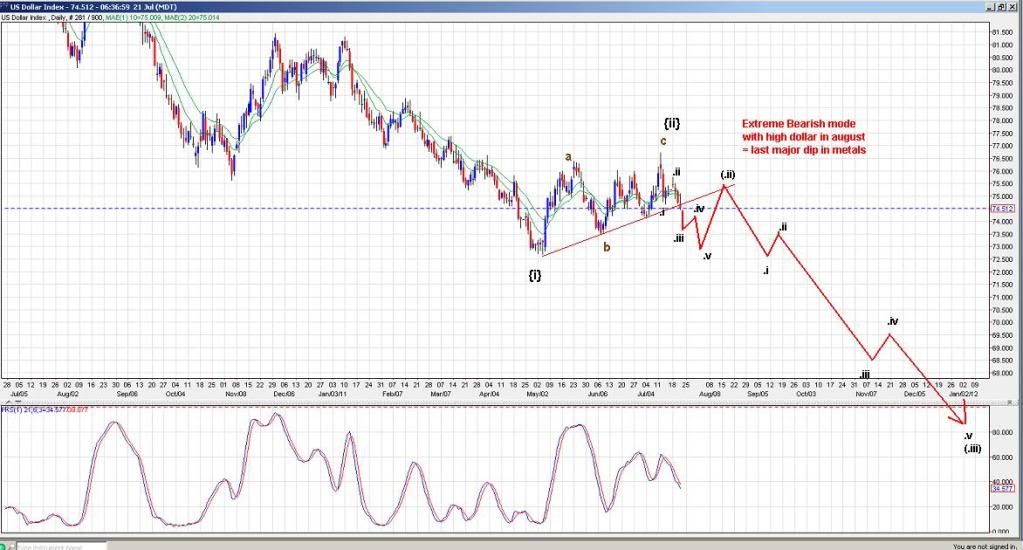

Watching the USD (United States Dollar index), I am still working off this older LT count:

I am basically looking for the completion of this choppy corrective move and resumption of the larger downtrend into wave {3} Blue.

My Previous count was anticipating a little further upside as an ending diagonal into August. However, Key Support (KS) was broken at 74.13, killing the ending diagonal interpretation:

With USD falling below that key support, other interpretations have come into focus.

If USD stays within the Bear Flag (orange channel lines) And Wave (C) = Wave (A) in both price and time, we could see one last surge for USD higher toward 77ish, near Aug 15th. Also very close to my Fibo turn date in Gold near Aug. 18th. This interpretation will likely fail to the downside if USD continues to tumble in the near term below the lower orange channel line.

A fellow Elliotician, Silverrex , a member of Kitco and frequent poster on my thread there, has suggested another credible count:

(click chart for full view)

This count would suggest that wave {2} blue is cooked and the descent into wave {3} has began. The 5 wave move down that he anticipated would be counted as a wave (.i) and is near complete. Soon a small wave (.ii) pull-back should be a choppy 3 wave move higher, likely keeping below the red trend-line.

In either case, the next upward move should be terminal, with a strong 3rd wave down to follow, if our interpretations are correct. As previously stated in the ending diagonal chart, any move in USD above 78.00 is likely to put larger downtrend in jeopardy.

Also note the weekly chart:

If USD close this week on Friday above 74.16, a bullish Hammer candle would be printed, suggesting a bounce is possible into next week.

In A Nut Shell:

USD may have one more move higher in the short term, likely completing inside 15 trading days and below 77.00. Then a strong move down into wave {3} could easily take the index to 68.00 for starters. The move to the downside is likely in trouble if USD instead moves above 78.00.

Here is the very long term chart and wave count that I prefer at this time. This is old from Dec '10 and needs and update. Basically we are about to finish wave {2} blue and head down into wave {3} blue. 70.80 will likely be the 'Point of Recognition' as the bull count would officially die crossing that level to the downside. This bear count suggest an eventual target in the 50s:

...