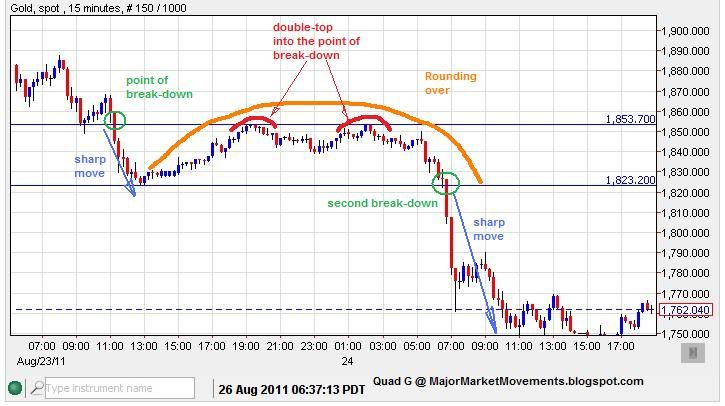

The recent plunge in gold price gave us a good look at a couple useful patterns that could have been traded off of.

This first is a common rounding over pattern that often occurs in a market that is working on a capitulative sell-off.

Once the the price starts to round down and move below the previous low this is the opportunity to sell or go short. In this case moving below 1823 was the key to further downside.

After the break-down many were wondering where a bottom was at. If you were up very early that morning (2am to 6am PST) you would have seen this bullish pattern and had a chance to take advantage of it.

The end of the shadow of the first red hammer candle was the stop-loss level, under 1702.90. The shadow of the second blue hammer candle was the entry, in this case you would have saw a panic sell down to 1704 then the rebound (approx risk of $2 near the lowest point). This particular set up gave a very low risk buy op. Risking less than 1% in the price of gold these days ($17-19) is very low risk. Of course you have to be awake to be able to see these opportunities. I've noticed that when the market is charging hard either up or down, many of the key tops and bottoms occur in the low-volume hours of the night and early morning.

...