A friend of mine was recently discussing his grandfather's attitude toward investing. Having grown up during the great depression and witnessing the after-math of the stock market collapse from 1929 to 1932, he and many of his generation have carried with themselves to this day a lingering distrust for the stock market. It's hard to believe but the darling investment of the past several decades was once reviled by the masses some almost 80 years ago. In my estimation we are clearly in the winter season, with another 8-10 years to slog through. For further study, here is a look at the 80 year Kondratieff Long Cycle: http://northcoastinvestmentresearch.files.wordpress.com/2009/01/kondratieff-cycle.jpg

So what does a transition from love to hate for stocks look like? I can think of no better model then that of the past. Here is a look at the stock market crash from 1929 to 1932:

If we were to compare similar moves to that of the stock market crash of 1929 to 1932, I would say the 'dodged bullet' has made a u-turn and homed back in! From the market high in May 2011 at 12,876 an 85% decline would target a Dow of 1,931 points. Does it take this kind of extreme to cause the majority of investors to despise stocks? Since the 20 year 'Winter' is only half way complete, having started in Jan 2000, there is still plenty of time to find out.

The January 2000 top in the market initiated a customary multi-year rounded top. With the latest drop of the last few weeks, the SM is now negative after 11+ years. How frustrating is that? Minus dividends the SM has basically moved in a neutral sideways pattern for 11 years. This has certainly set up a bit of disillusionment with many investors for the first half of this winter cycle. But Stocks have yet to feel the 'hate' by the masses that signifies a long term bottom. I think that time is approaching and quickly.

From my point of view, the stunning fall that started a couple weeks ago is but a drop in the bucket compared to what I anticipate to happen.

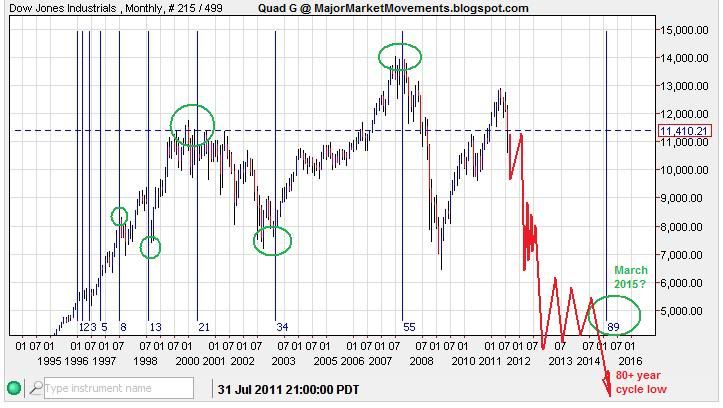

Let's take a look at the Dow industrials long term topping action:

From the year 2000 the SM has basically created a very large, rounded head and shoulder pattern. The right shoulder of the pattern appears to be clearly defined as a sharp 3 wave correction labeled wave {2} blue. If this interpretation is correct, the top set on May 2nd at 12,876 should be locked in, most likely for 2 decades or longer before it is exceeded. The Wave count to the downside is idealized. As always I will adjust the count as needed on a wave by wave basis. Similar to the 1929 to 1932 collapse, the next phase is likely to be prolonged and deep.

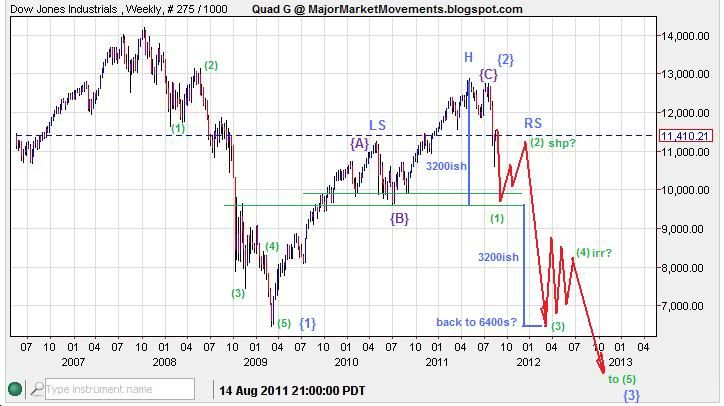

Zooming in closer we can see a bit more detail and the possible set up of another bearish HnS pattern:

If the Dow continues it's sell-off toward a lower-low preferably into a support zone between 9600 and 9900 this should complete the right neck of another bearish HnS with the built-in potential to eventually plunge the Dow down to 6400 again in just a few months time. The FED may announce another easing program, but since the effects of QEII has already been mostly wiped-out, any new easing may only produce a lower-high as a right shoulder. I think we have arrived at 'Peak-Government' and 'Peak-FED' their ability to affect change in the markets appears to be diminishing.

Now that we have a rough target in price and rough pattern to follow, how about timing. Perhaps a Fibonacci measurement of time will present a clue:

The golden ratio set of numbers in the monthly time frame suggests that roughly march 2015 is a possible target for a low.

Gold continues to push higher in response to the Dow's collapse. These movements are all part of a long journey for the Dow to once again reach parity with the price of Gold, a ratio of 1:1. I currently suspect the meeting will likely take place some time between 2015 and 2016 at roughly $2000 to $3000 an ounce gold.

The Dow:Gold ratio also reached parity back at the gold top in 1980. At that time, a market driven gold market was RISING in an attempt to accurately valuate the Dow in real money. But now in this current cycle, I think the Dow will be FALLING significantly to find it's true value in real money - Gold.

...