Silver has finished a 5 wave impulsive series and is now into a correction phase. The 3/10/20 ribbon bears witness:

The bearish cross-over certainly ended the previous impulsive trend stepping into a correction. If PoS continues to operate below the 20DMA on a daily closing basis, the trend will still remain to the downside. I would advise caution with buys while the 3/10/20 is in this configuration.

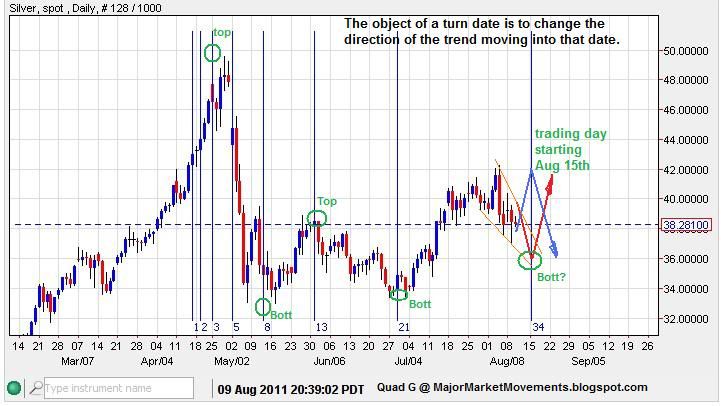

There is a possible Fibo turn date coming up on the daily chart:

The trading day that starts on the 15th, +/- 1 day covers a window of time from Sunday's open on the 14th to the afternoon close on Wednesday the 17th. If the current downward trend continues into that turn date window then I would anticipate a turn to the upside (red projection). But the opposite is also true, if PoS moves higher into that date, then a top is possible. A turn date only suggests a possible turn of the trend that arrives into it.

Here is a current EW perspective:

I currently suspect that Silver's correction is nothing but a Back-Test (BT) of the previous broken trend-line (green). If so, further selling may bring silver down into the Aug 15th turn window, which may end a wave {ii} blue sharp correction. Based on the size of wave {i}, a wave {iii}blue should have little trouble moving p to 51.13 or better as an initial target.

If Silver breaks the dashed red trend-line, the larger bull-trend is in jeopardy and a slide down to sub-30 is very possible.

...