Dedicated to the pursuit of identifying significant turns and trends in multiple markets using the Elliot Wave Theory, Japanese Candlesticks, Cycles, Seasonals and basic technical analysis.

Monday, August 8, 2011

Gold Update - 8/8/11

Mornin' all,

Gold:

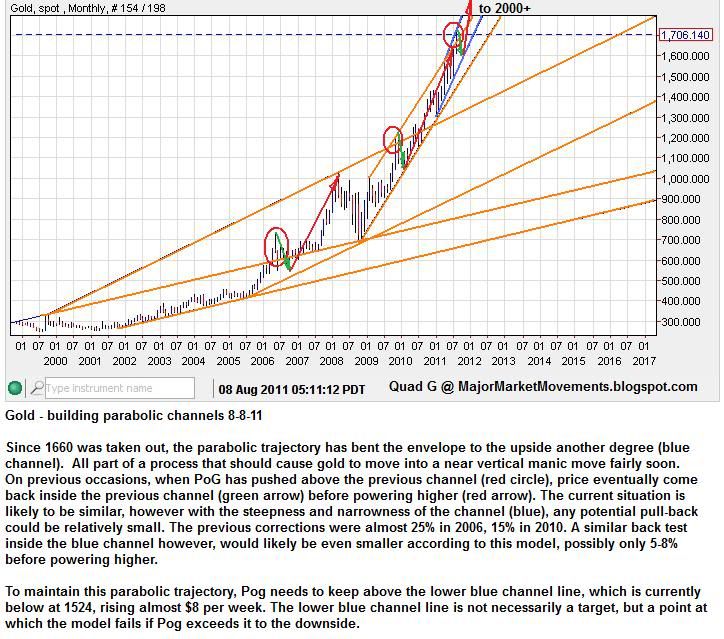

Since 1660 was taken out, Gold continues to bend the parabolic envelope steeper. IMHO, this market is preparing to go vertical soon in a final manic buying spree.

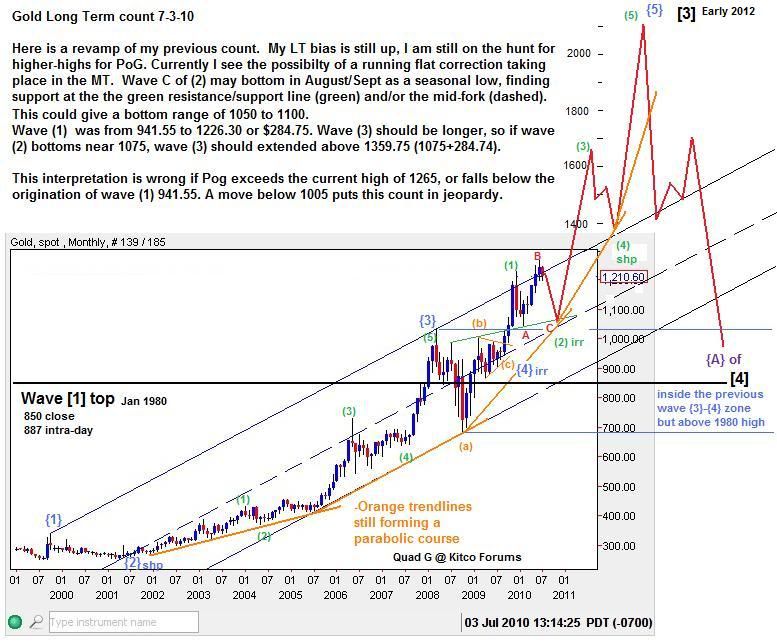

Here is an older chart depicting the concept of building a parabola:

Here is an update on how the parabolic move is progressing:

Today is August 8th and a potential fibo turn-date window here, centered on August 9th (+/- 1 day). Netdania shows it's dates in the measuring tool as the beginning date, which actually starts in the afternoon of the previous day, pardon the confusion. Chart:

You'll notice that every point except one has marked a turn, some bigger than others. A Fibonacci turn-date is not a certainty, but adds to the probability.

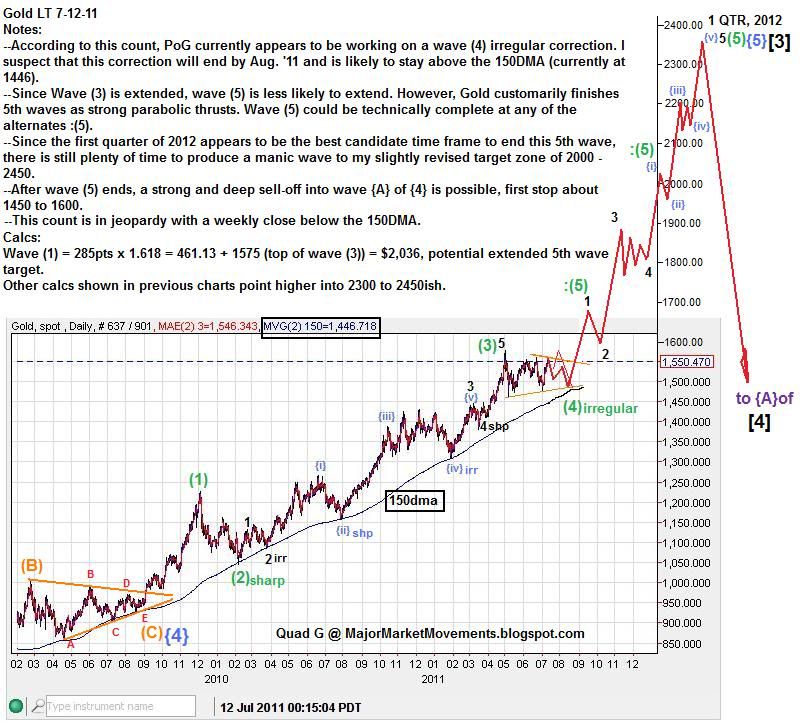

Here is the MT count for Gold that I am currently working off of:

Update:

The current 3/10/20 ribbon and ST EW count:

I would not be surprised to see PoG come back to fill the gap at least partially, test the 10EMA again, and then gap higher into a small wave (v) green toward 1742 to 1760ish to finish wave 1 black. But the 10 EMA must hold on a daily closing basis.

...

Labels:

3/10/20 ribbon,

Gold,

Time Fibos