Last week closed on a very bullish note, weekly chart:

The weekly chart posted a Bullish Red Hammer candle for last week. To maintain the bullishness of this candle, this week's close must remain above 1702.48. Also, if last week had closed below the previous week's low of 1732.80 it would have posted a bearish Outside Key Reversal (OKR) on the weekly, that would have been very bearish. However, with the Red hammer instead that potential has disappeared.

The daily chart shows even more bullish behavior:

As you can see, the 20DMA has given support over the last 3 days, 2 intra-day bounces and a daily close above to produce a bullish hammer candle. The 3/10/20 had moved into a neutral alignment for a day, but Friday's action returned the ribbon to a bullish alignment which can be maintained with continued daily closes above the 10EMA (currently 1797).

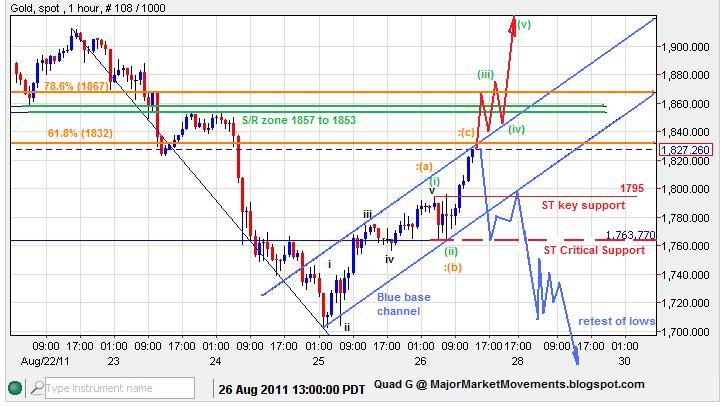

The Elliot wave picture is at an important cross roads:

Friday's close ended just below the 61.8% fibo retrace and the Blue base channel. The Base channel often defines an ABC corrective move (orange :(a),:(b):(c) count) or helps confirm a 3rd wave break-out (green (i), (ii), (iii), (iv), (v) count).

Red Projection - If PoG continues the buying spree and moves above the base channel early next week, staying above 1795, then an impulsive 5 wave structure will be built which could lock-in the wave 2 black low at 1702.

Blue Projection - an early sell-off next week rejecting the 61.8% fibo and upper base channel line, impulsively moving down below 1763 would suggest a retest of the previous low is possible.

Zooming out we can see how these moves would play in the larger MT picture:

A third leg down of an ABC zig-zag would be possible with the conditions of the Blue projection. An obvious target is the daily gap up (1662 to 1682) and the 61.8% fibo at 1643. These are obvious targets, however a very bullish market may not be generous enough to fall to those levels. Again if the blue base channel is breached the low at 1702 could be as good as it gets and wave 3 black higher may be underway. Keep in mind that the 1643 level guards the MT trend higher, falling below that level puts the MT count in jeopardy, not dead, but in trouble. Death would come with any move below 1478.

Wave 1 black moved higher (complete at 1912) than earlier anticipated. This suggests that the next wave up, 3 black, has a new minimum target of 2136 and possible extended target of 2614. Afterward a wave 4 black pull-back (likely irregular,flat) and then a final 5th which could move 'crazy high' then have an even crazier crash.

As I said before the original Primary count up from the 1999 low is technically complete for a major multi-year top. Moving below 1478 impulsively would confirm that view. This is not my favored view at this time, I still think PoG has only finished the first stage of this mania blow-off top as the 5th wave continues to extend higher ala 1980.

Good Hunting.

...