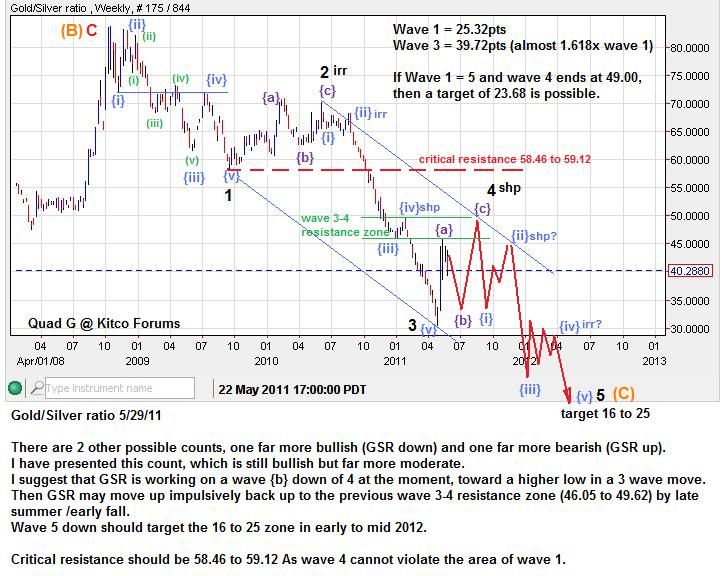

Since the GSR low in early May I've been looking for a {b} wave correction to end and one last thrust higher into {c} to finish a sharp correction for wave 4 black:

Here is the outlook from May:

Originally I though wave {b} may have formed a bullish triangle, but it failed to the downside. However, the pattern has realized another type of flat correction that should be complete or near complete.

Updated MT view:

Updated ST view:

This interpretation suggests wave {b} is about cooked with a wave {c} higher to come. However, a move below the orange channel (green arrow) would significantly reduce the chances of a wave {c} being produced.

Upside resistance creates a zone between 46ish to 50ish. A 'sweet spot' with in that range is about 47ish to 49.62.

The long term chart shows a major trend-line that was broken at the first of the year. A wave {c} up may attempt to touch this trend-line as a back test (near 47ish and climbing), before heading lower into wave 5 black.

In A Nut Shell:

If GSR currently remains above the lower orange channel line, chances are good that one more move higher is possible into a zone between 46 to 50ish. Such a move would likely be terminal to the upside facing multiple points of resistance. Upon completion of this proposed sharp correction for wave 4 black, the gravity of the larger trend should resume and pull GSR lower toward my long term target range of 16 to 25. If GSR moves higher above 50ish, above the upper blue channel line, the downward trend is in jeopardy. Any move above 58.46 would kill this EW pattern with a wave 1/4 overlap violation.

...