The numbers are finally crunched and packaged ever so nicely:

(click on chart for full view)

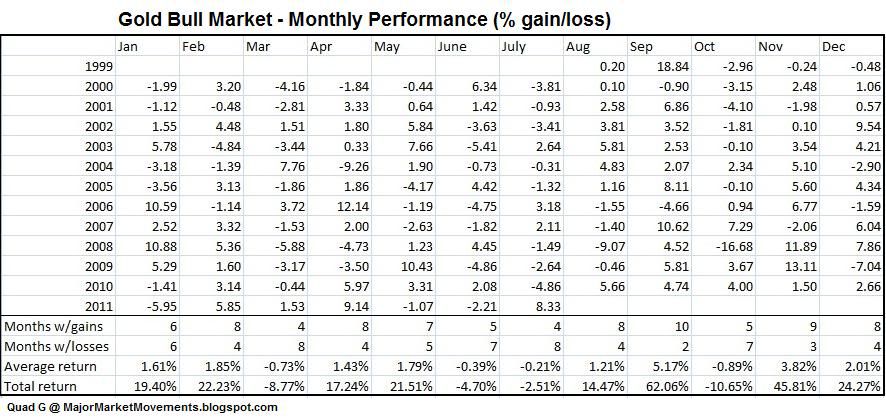

The individual monthly performance data shown is calculated using the monthly open and close of each month listed. Intra-month extremes are not considered. Data starts from the beginning of the Gold Bull Market in August 1999.

After reviewing the statistical data, it's easy to see that September is the sweetest month for gold by far. If an investor had simply bought gold at the open and sold gold at the close of every September since the bull market bottom, they would have enjoyed an average monthly Return On Investment (ROI) of 5.17% average per year for a total ROI of 62.06%.

September is also the 'winningest' month, 10 out of 12 months were gainers.

Now it would appear that October is an ominous shadow on the other side of September with the 'losingest' record. However, if the High/low extremes were factored out, eliminating the one glaring eyesore of Oct. 2008, June would actually be the 'losingest' month.

September is also the kick-off month for Gold's most bullish period of the year, extending from the August low till a February top:

Unless the price of gold encounters some statistically improbable inversion against the seasonal trend, this would be the perfect time to witness parabolic advances into the first Quarter of 2012.

...